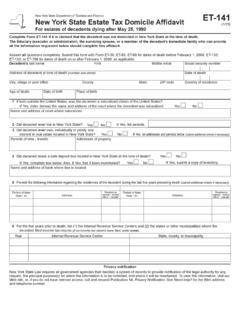

Form ET-141:1/15:New York Estate Tax Domicile Affidavit:et141

Complete Form ET-141 if it is claimed that the decedent was not domiciled in New York State at the time of death. The fiduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family who can provide

Download Form ET-141:1/15:New York Estate Tax Domicile Affidavit:et141

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

Department of Taxation and Finance New York …

www.tax.ny.govDepartment of Taxation and Finance New York State and Local Sales and Use Tax Resale Certificate Mark an X in the appropriate …

Form ST-125:6/18:Farmer's and Commercial Horse …

www.tax.ny.govI certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated below. The property or service(s) will be used or consumed in farm production or in a commercial horse boarding

Department of Taxation and Finance Department …

www.tax.ny.govImportant information For returns due on or after April 30th, 2015, you must electronically file your quarterly returns and pay any balance due.

Form TP-584:4/13:Combined Real Estate Transfer …

www.tax.ny.govNew York State Department of Taxation and Finance Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption from the

Finance, York, Department, States, Direct, Certificate, Taxation, Mortgage, Mortgage certificate, Tp 584, New york state department of taxation and finance

Power of Attorney - New York State Department of …

www.tax.ny.gov02900106170094 New York State Department of Taxation and Finance New York City Department of Finance Power of Attorney POA-1 (6/17) Read instructions on the back before completing this form.

Finance, York, Department, States, Power, Attorney, Taxation, Power of attorney, New york state department of taxation and finance

Form ST-100:3/18:New York State and Local …

www.tax.ny.gov50000105180094 1 1a 1b.00.00.00 New York State and Local Quarterly Sales and Use Tax Return Department of Taxation and Finance Quarterly ST …

What is the Senior Citizens’ Exemption? How do I …

www.tax.ny.govWhat is the Senior Citizens’ Exemption? The Senior Citizens’ Exemption is a benefit program that reduces your property taxes by 50%. If you’re 65

Publication 910:6/18:NAICS Codes for Principal …

www.tax.ny.govAgriculture, Forestry, Fishing and Hunting Crop Production 111100 Oilseed & Grain Farming 111200 Vegetable & Melon Farming 111300 Fruit & Tree Nut Farming

Department of Taxation and Finance ST-120.1 …

www.tax.ny.govDepartment of Taxation and Finance New York State and Local Sales and Use Tax Contractor Exempt Purchase Certificate To vendors: You must collect tax on any sale of taxable property or services unless the contractor gives you a properly

Finance, Department, Certificate, Taxation, Department of taxation and finance

New York State Department of Taxation and …

www.tax.ny.govNew York State Department of Taxation and Finance Instructions for Form TP-584 Combined Real Estate Transfer Tax Return, Credit …

Finance, York, Department, States, Instructions, Taxation, New york state department of taxation and, New york state department of taxation and finance instructions

Related documents

REQUIREMENTS/APPLICATION FOR RECIPROCAL REAL …

www.dbr.ri.govCRIMINAL HISTORY RECORD SUBMISSION REQUIREMENTS . FOR BROKER AND SALESPERSON APPLICANTS . A Criminal History Record (“CHR”) must be submitted to the Real Estate Section of the Department of Business Regulation (“DBR”), Division of Commercial Licensing with each Real Estate …

Applications, Requirements, Real, Estate, Reciprocal, Requirements application for reciprocal real

MARYLAND ESTATE TAX RETURN - forms.marylandtaxes.gov

forms.marylandtaxes.govCOM/RAD-101 18-49 Form MET 1 Rev. 07/18 USE THIS AREA FOR DATE STAMPS Revenue Administration Division P.O. Box 828 Annapolis, MD 21404-0828 MARYLAND ESTATE TAX RETURN

Mailing Addresses for D.C. Tax Returns Form Mailing ...

otr.cfo.dc.govGovernment of the District of Columbia Office of the Chief Financial Officer Office of Tax and Revenue Mailing Addresses for D.C. Tax Returns

Return, Mailing, Addresses, Tax return, Mailing addresses for

2018 Form 1041 - irs.gov

www.irs.govForm 1041 Department of the Treasury—Internal Revenue Service . U.S. Income Tax Return for Estates and Trusts. 2018. OMB No. 1545-0092. For calendar year 2018 or fiscal year beginning

The Estate Tax: Ninety Years and Counting

www.irs.gov118 F or the past 90 years and at key points through-out American history, the Federal Government has relied on estate and inheritance taxes as

2017 Form OR-706 Office use only - oregon.gov

www.oregon.govOregon Department of Revenue 2017 Form OR-706 Oregon Estate Transfer Tax Return Submit original form—do not submit photocopy. Office use only Page 1 of 3, 150-104-001 (Rev. 07-17) 17511701010000 Decedent’s first name and initial Decedent’s last name Decedent’s Social Security number (SSN), Estate

Column A Column B - Department of Taxation and Finance

www.tax.ny.gov506001170094 Department of Taxation and Finance Authorization for Release of Photocopies of Tax Returns and/or Tax Information DTF-505 (4/17) Part A – Taxpayer information