10 Capital Allowances Basic

Found 10 free book(s)INLAND REVENUE BOARD OF MALAYSIA QUALIFYING …

www.hasil.gov.mythe purpose of claiming capital allowances; and (b) computation of capital allowances for expenditure on plant and machinery. 2. Relevant Provisions of the Law 2.1 This PR takes into account laws which are in force as at the date this PR is published. 2.2 The provisions of the Income Tax Act 1967 (ITA) related to this PR are paragraphs 2, 2A ...

INLAND REVENUE BOARD OF MALAYSIA QUALIFYING …

lampiran1.hasil.gov.mythe purpose of claiming capital allowances; and (b) computation of capital allowances for expenditure on plant and machinery. 2. Relevant Provisions of the Law 2.1 This PR takes into account laws which are in force as at the date this PR is published. 2.2 The provisions of the Income Tax Act 1967 (ITA) related to this PR are paragraphs 2, 2A ...

Tax and Duty Manual Part 35A-01-01 Transfer Pricing

www.revenue.ieon or after 1 January 2020 and, in relation to the computation of certain capital allowances where the related capital expenditure is incurred on or after 1 January 2020. In relation to the computation of balancing allowances and balancing charges, Part 35A applies where the event giving rise to the balancing allowance or balancing

LONDON ALLOWANCES - UNISON

www.unison.org.ukeconomic factors underpinning allowances, practical advice for negotiations and prevailing rates in the public and private sectors. Background London allowances have their roots in the 1974 report of the Pay Board, which recommended an extra payment to compensate for the extra costs of living in the capital.

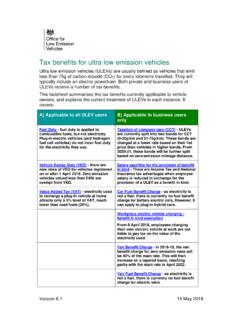

Tax benefits for ultra low emission vehicles

assets.publishing.service.gov.ukEnhanced Capital Allowances (ECAs) - businesses that purchase cars which emit less than 75g CO 2 /km, zero emission goods vehicles, or ULEV recharging or refuelling infrastructure, are eligible for 100% first year allowance. Approved Mileage Allowance Payment (AMAPs) - electric and hybrid cars are treated in the same way as petrol and diesel cars.

REPUBLIC OF THE PHILIPPINES DEPARTMENT OF BUDGET …

www.dbm.gov.phguaranteed allowances (such as Personal Economic Relief Allowance) and bonuses (such as 13th month pay). For the study, the DBM used 2014 data of the General Industry rates and made a projection up to 2016. The purple line in this line chart shows actual market data. Since the data on private sector pay is

INSTRUCTIONS FOR THE CHILD SUPPORT GUIDELINES …

www.dshs.wa.govmental Security Income (SSI), Food Stamps, Section 8 Housing Allowances, General Assistance Grants, Pell Grants, and benefits received from the Jobs Training Partnership Act or WIC. ASSETS FOR PAYMENT OF SUPPORT may be applied when a parent has inadequate income to meet his/her child support obligation. If the parent owns assets, he/she may be

Jordan Highlights 2020 - Deloitte

www2.deloitte.com10% 10% Dividends – There generally is no withholding tax on dividends paid to nonresidents, although the situation for certain persons currently is unclear. Dividends paid to residents are not subject to withholding tax, except for dividends paid to banks, primary telecommunication, basic material mining, insurance,

Financial Regulations for FY2021 (1 July 2021- 30 June 2022)

www.apn-gcr.org1 Financial Regulations for FY2021 (1 July 2021- 30 June 2022) These regulations will guide the Project Leader1, Authorized Representative of the Grantee2 and Project Collaborators on: i. what expenses can/cannot be covered, and to what extent; ii. correct and thorough administration of APN funds by the Project Leader, including that of Collaborators’ institutions listed in the …

STAFF REGULATIONS, RULES AND INSTRUCTIONS

www.oecd.orgstaff regulations, rules and instructions applicable to officials of the organisation october 2021