2016 individual income tax

Found 29 free book(s)WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX?

revenue.louisiana.govWHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? 1 SPEC CODE ... WHO MUST FILE A RETURN 1. If you are a Louisiana resident who is required to file a federal individual income tax return, you must file a Louisiana income tax return reporting all income earned in 2016. 2. You must file a return to obtain a refund or credit if you overpaid ...

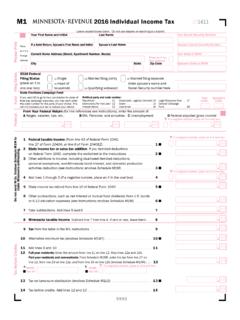

M1 2016 Individual Income Tax 201611

www.revenue.state.mn.us2016 Individual Income Tax Leave unused boxes blank . Do not use staples on anything you submit . State Elections Campaign Fund If you want $5 to go to help candidates for state of-fices pay campaign expenses, you may each enter the code number for the party of your choice . This

WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME …

revenue.louisiana.govWHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX? This space on the fourth page of the tax return is to be used only when specifically instructed by the Louisiana Department of Revenue (LDR). Otherwise, leave blank. WHO MUST FILE A RETURN (Form IT-540B) 1. If you are a nonresident, or part-year resident, with income from

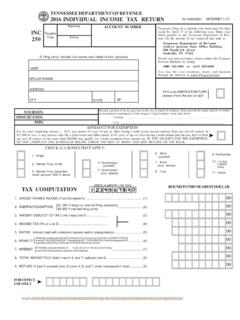

TENNESSEE DEPARTMENT OF REVENUE 2016 INDIVIDUAL …

www.tn.gov2016 individual income tax return Because a portion of the tax goes back to the city or county of residence, please provide the county and city (if within an incorporated municipality) of the taxpayer’s legal residence on the lines below.

Individual Income Tax Rates, 2016 - irs.gov

www.irs.govIndividual Income Tax Rates, 2016 Individual Income Tax Returns 2016 29 2 Marginal tax rate as cited in this article is the highest statutory rate on taxable income. It includes ordinary tax rates and capital gains tax rates. This concept does not include the effects of AMT,

State Individual Income Tax Rates and Brackets for 2016

files.taxfoundation.org3 Notable Individual Income Tax Changes in 2016 Several states changed key features of their individual income tax codes between 2015 and 2016. These changes include: · Arkansas lowered its top marginal rate from 7 percent to 6.9 percent on income over $35,100. Also, it adopted a new tax schedule for individuals earning

2016 M1, Individual Income Tax Return

www.revenue.state.mn.us2016 Individual Income Tax Leave unused boxes blank . Do not use staples on anything you submit . State Elections Campaign Fund If you want $5 to go to help candidates for state of-fices pay campaign expenses, you may each enter ... 2016 M1, Individual Income Tax Return

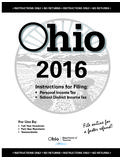

PIT IT1040 Booklet WLinks 2016 FS 122816

www.tax.ohio.gov2016 Instructions for Filing: Personal Income Tax School District Income Tax ... Check the status of your 2016 Ohio income tax refund, get answers to the most fre- ... Ohio's individual income tax brackets have been indexed for inflation per Ohio Revised Code section 5747.025.

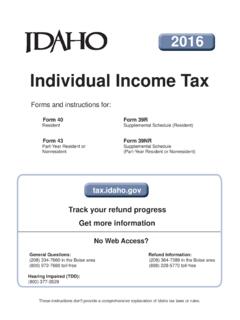

Individual Income Tax Instructions Packet

tax.idaho.gov2016 Individual Income Tax These instructions don't provide a comprehensive explanation of Idaho tax laws or rules. General Questions: Refund Information: (208) 334-7660 in the Boise area (208) 364-7389 in the Boise area ... instructions, see Form 39R or Form 39NR. ASSEMBLING THE IDAHO INDIVIDUAL RETURN. tax.idaho.gov.

Form ND-1 - Individual Income Tax Return

www.nd.gov(AE) 23 (SQ) 30 (AK) (AL) a. North Dakota Office of State Tax Commissioner 2016 Form ND-1, page 2 19. Enter your North Dakota taxable income from line 18 of page 1 21. Credit for income tax paid to another state or local jurisdiction

Mississippi Resident Individual Income Tax Return ...

www.dor.ms.govMississippi Resident Individual Income Tax Return 2016 Page 2 801051682000 Form 80-105-16-8-2-000 (Rev. 4/16) SSN Column A (Taxpayer) Column B (Spouse)

Full-Year Resident Individual Income Tax Booklet

www.in.govIT-40 Booklet 2016 Page 3 Which Indiana Tax Form Should You File? Indiana has three different individual income tax returns. Read the following to find the right one for you to file.

2017 Colorado Individual Income Tax Return

www.colorado.gov2017 Colorado Individual Income Tax Return Full-Year Part-Year or Nonresident (or resident, part-year, non-resident combination) *Must attach DR 0104PN Mark if Abroad on due date – see instructions Your Last Name Your First Name Middle Initial ... 9/20/2016 11:32:55 AM ...

VIrginia Resident Return Form 760 - Home | Virginia Tax

tax.virginia.govIndividual Income Tax Return File by May 1, 2017 - PLEASE USE BLACK INK - - - Do you need to file? See Line 9 and Instructions - - - ... Virginia income tax withheld for 2016. Enclose copies of Forms W-2, W-2G, 1099 and/or VK-1. ... VIrginia Resident Return Form 760 Created Date:

WHAT’S NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME …

esweb.revenue.louisiana.govInventory Tax Credit – Code 50F – Act 4 of the 2016 Second Extraordinary Session changed the limitation on the amount of the excess credit over tax that is refunded, and required that groups of affiliated companies be treated as one taxpayer for

2016 Individual Income Tax Instructions, Individual Income ...

www.ksrevenue.org2016 Individual Income Tax For a fast refund, ile electronically! See back cover for details. ... However, you must ile a Kansas individual income tax return to receive any refund of taxes withheld, regardless of the amount of total income. NONRESIDENTS. If you are not a resident of Kansas but received income from Kansas sources, you must ile ...

2016 Individual Income Tax Instruction Booklet

www.ksrevenue.orgIf you are an individual taxpayer (including farmer or isher), use this schedule to determine if your income tax was fully paid throughout the year by withholding and/or estimated tax payments. ... 2016 Individual Income Tax, 2016 Income Tax Instruction Booklet, K-40, Sch S, K-40V

2016 SC1040 INDIVIDUAL INCOME TAX FORM & …

dor.sc.govjanuary 2017 2016 sc1040 individual income tax form & instructions 2016 sc1040 individual income tax form & instructions south carolina department of revenue

2016 DELAWARE 2016 Resident Individual Income Tax Return

revenue.delaware.govPage 2 Form 200-01 RESIDENT INDIVIDUAL INCOME TAX RETURN GENERAL INSTRUCTIONS Who Must File 1. If you are a Full-Year Resident of the State, you must file a tax return for 2016 if, based on your Age/Status, your individual

2016 Individual Income Tax Return Long Form MO-1040

dor.mo.govINDIVIDUAL INCOME TAX ADJUSTMENTS 2016 FORM MO-A ATTACH TO FORM MO‑1040. ATTACH A COPY OF YOUR FEDERAL RETURN. See information beginning on page 11 to assist you in completing this form. Attachment Sequence No. 1040-01 PART 1 — MISSOURI MODIFICATIONS TO FEDERAL ADJUSTED GROSS INCOME (SEE PAGE 11).

2016 540 Instructions California Resident Income Tax Return

www.ftb.ca.govPersonal Income Tax Booklet 2016 Page 9. 2016 Instructions for Form 540 — California Resident Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of . January 1, 2015 ... individual AGIs from their federal tax returns filed with the IRS. Enter the

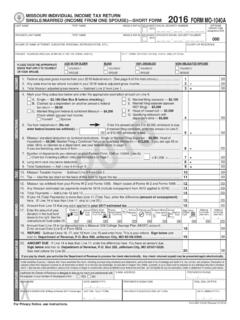

2016 Individual Income Tax Return Short Form MO-1040A

dor.mo.govFORM MO-1040A. Form MO-1040A (Revised 12-2016) Complete this worksheet only if your federal adjusted gross income from federal Form 1040, Line 37 is more than $311,300 if married filing combined or qualifying widow(er),

2016 Individual Municipal Income Tax Forms - CCA

ccatax.ci.cleveland.oh.us2016 EXEMPTION CERTIFICATE @SHOW NAME OR ADDRESS CHANGES ON REVERSE. EXEMPTION CERTIFICATE I LIVE IN A MANDATORY FILING CITY AND I AM NOT REQUIRED TO PAY CITY INCOME TAX BECAUSE: 1. @RETIRED, received only pension, Social Security, interest or dividend income

2016 Nebraska - Pennsylvania Department of Revenue

www.revenue.nebraska.gov8-307-2016 2016. Nebraska. Individual Income Tax . Booklet. All taxpayers can use the Fed/State program to e-file federal and . Nebraska tax returns. File online by purchasing software from a retailer, or with a tax …

2016 - Inland Revenue Department

www.ird.govt.nzIndividual income tax return guide 2016 Please read page 5 to see if you need to file this return. Complete and send us your IR3 return by 7 July 2016, unless you have an extension of time to file or a non-standard balance date. The information in this guide is based on current tax laws at

SC1040 DEPARTMENT OF REVENUE 2016 INDIVIDUAL …

dor.sc.govFor the year January 1 - December 31, 2016, or fiscal tax year beginning 2016 and ending 2017 Mailing address (number and street, Apt. no or P. O. Box) Foreign address, see instructions County code Suff.

2016 Form 1040 - Internal Revenue Service

www.irs.govForm 1040 Department of the Treasury—Internal Revenue Service (99) U.S. Individual Income Tax Return . 2016. OMB No. 1545-0074. IRS Use Only—Do not write or staple in this space.

2016 Form OR-40 Office use only - oregon.gov

www.oregon.gov2016 Form OR-40 Oregon Individual Income Tax Return for Full-year Residents Page 1 of 4, 150-101-040 (Rev. 12-16) Last name Spouse’s last name Date of birth (mm/dd/yyyy) Spouse’s date of birth First name and initial Spouse’s first name and initial Social Security no. (SSN) Spouse’s SSN Deceased Deceased Applied for SSN

2016-tax-brackets - taxpolicycenter.org

www.taxpolicycenter.orgThreshold for Refundable Child Tax Credit If your filing status is Head of Household If your filing status is Married filing separately

Similar queries

2016 Individual Income Tax, Individual Income Tax, INCOME TAX, Income, 2016, NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME, NEW FOR LOUISIANA 2016 INDIVIDUAL INCOME TAX, TENNESSEE, 2016 INDIVIDUAL, State Individual Income Tax Rates and, 2016 M1, Individual Income Tax Return, 2016 Instructions, Individual Income Tax Instructions, Instructions, Idaho tax, IDAHO INDIVIDUAL, 1 - Individual Income Tax Return, North Dakota, Mississippi Resident Individual Income Tax, Full-Year Resident Individual Income Tax Booklet, VIrginia Resident Return Form 760, 2016 Individual Income Tax Instructions, Individual Income, Individual, 2016 Income Tax, 2016 sc1040 individual income tax form, 2016 DELAWARE 2016 Resident Individual Income Tax, 2016 Individual Municipal Income Tax Forms, 2016 Nebraska, Pennsylvania Department of Revenue, 2016 2016. Nebraska, 2016 Form 1040, Internal Revenue Service, Form 1040