6 House Rent Allowance Conveyance

Found 8 free book(s)Government of Pakistan - Ministry of Finance

finance.gov.pkHouse Rent Allowance: House Rent Allowance shall be admissible with reference to the Revised Basic Pay Scales, 2005 subject to the existing conditions. 8. Medical Allowance: Medical Allowance shall be admissible @ Rs.425/- p.m. subject to the existing conditions. 9. Conveyance Allowance: (a) Conveyance Allowance shall be admissible on revised ...

Income Tax Deductions List FY 2020-21 | New Vs Old Tax ...

www.relakhs.comHouse rent allowance Leave Travel Allowance Standard Deduction of Rs 50,000 Deduction available under section 80TTA (Deduction in respect of Interest on ... Conveyance Allowance 4/12. You can claim income tax exemption for conveyance, travel and other allowances given by your employers under the new tax regime as well.

FORM NO. 12B Form for furnishing details of income under ...

www.incometaxindia.gov.inhouse rent allowance, conveyance allowance and other allowances to the extent chargeable to tax[See section 10(13A) read with rule 2A and section 10(14)] Value of perquisites and amount of accretion to employee's provident fund account (give details in the Annexure) † Total of columns 6, 7, and 8 Amount deducted in respect of life insurance

Provident Fund applicability on allowances - Deloitte

www2.deloitte.comliving), house-rent allowance, overtime allowance, bonus, commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment; • any presents made by the employer Section 2(b) read with section 6 of the Provident Fund Act provides that contributions are required to be paid on:

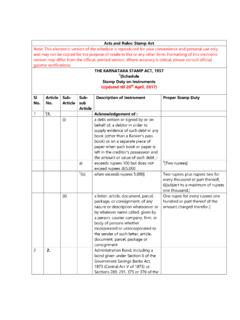

Acts and R ules: Stamp Act THE KARNATAKA STAMP ACT, 1957

igr.karnataka.gov.inpension or charitable allowance. 1. Substituted for the words "Forty Five Rupees" by Act No.8 of 2003 w.e.f. 1 -4-2003. ... The same duty as a Conveyance (No. 20) for a market value equal to the security deposit and the amount of average annual rent reserved under such agreement. Housing Board Act, 1962, (Karnataka Act 10 of 1963), the

Signature of the employeeIndianHyderabadEmployee Signature

www.samplefilled.comof house perquisites columns deducted of tax deducted Employer(s) as allotted Number of ment excluding rent allow-and amount 6, 7 in respect during the by the the amounts ance, convey-of accre-and 8 of life year (enclose ITO employer(s) required to ance allowance tion to insurance certificate be shown in and other allow-employee ’ s premium ...

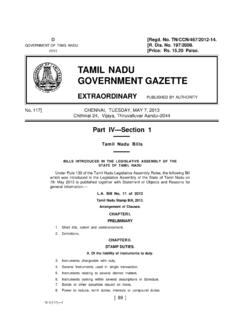

TAMIL NADU GOVERNMENT GAZETTE - Government of …

www.stationeryprinting.tn.gov.insubmitted to the Clearing House of an association in accordance with the rules or bye-laws of the association; (7) “Collector” means the Collector of a district and includes any officer specifically appointed by the Government to perform the functions of the Collector under this Act; (8) “conveyance” includes-(a) a conveyance on sale;

INTERNATIONAL FINANCIAL SERVICES CENTRES AUTHORITY ...

ifsca.gov.inFinancial Dailies, Staff Furnishing Scheme, Children Education allowance, Equipment maintenance allowance, Official entertainment allowance and Scheme for purchase of computer, etc. 5. Age limit as on March 31, 2022: Not more than 45 years of age as upper limit. 6. Eligibility conditions for deputation basis.