Age Affidavit Exemption

Found 8 free book(s)APPLICATION FOR RESIDENCE HOMESTEAD EXEMPTION

www.waller-cad.orgTax Code Section 11.43(m) allows a person who receives a general homestead exemption in a tax year to receive the age 65 or older exemption for an individual 65years of age or older in the next tax year on the same property without applying for the age 65 or older exemption if the person becomes 65 years of age in that

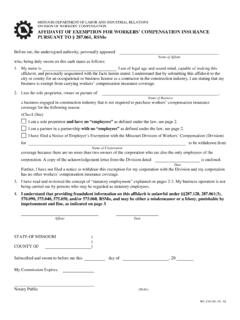

Affidavit of Exemption for Workers' Compensation Insurance

labor.mo.govAFFIDAVIT OF EXEMPTION FOR WORKERS’ COMPENSATION INSURANCE PURSUANT TO § 287.061, RSMo . Before me, the undersigned authority, personally appeared . Name of Affiant . who, being duly sworn on this oath states as follows: 1. My name is . I am of legal age and sound mind, capable of making this

Residence Homestead Exemption Application - Denton CAD

www.dentoncad.comhomestead. (See Form 50-114-A) An eligible disabled person age 65 or older may receive both exemptions in the same year, but not from the same taxing units. Contact the appraisal district for more information. Age 65 or Older Exemption (Tax Code Section 11.13(c) and (d)) This exemption is effective Jan. 1 of the tax year in which the property owner

MARYLAND FORM MW507

www.marylandtaxes.gov4.The employee claims an exemption from withholding on the basis of nonresi-dence; or 5. The employee claims an exemption from withholding under the Military Spous - es Residency Relief Act. Upon receipt of any exemption certificate (Form MW507), the Compliance Division will make a determination and notify you if a change is required.

5737, Application for MCL 211.7u Poverty Exemption

www.michigan.govMCL 211.7u of the General Property Tax Act, Public Act 206 of 1893, provides a property tax exemption for the principal residence of persons who, by reason of poverty, are unable to contribute toward the public charges. This application is to be . used to apply for the exemption and must be filed with the Board of Review where the property is ...

Affidavit of Consideration for Use By Seller - State

www.state.nj.usThis Affidavit must be annexed to and recorded with all deeds when entire consideration is not recited in deed or the acknowledgement or proof of the execution, when the grantor claims a total or partial exemption from the fee, Class 4 property that includes commercial, industrial, or apartment property, and

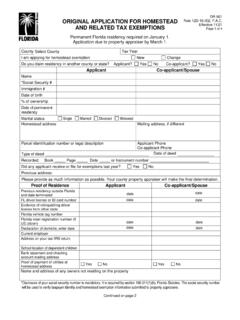

ORIGINAL APPLICATION FOR HOMESTEAD EXEMPTIONS

floridarevenue.comAge 65 and older with limited income and permanent residency for 25 year s or more . $500 widowed $500 blind $500 totally and permanently disabled : Total and permanent disability - quadriplegic ... for this exemption may qualify for a prorated refund of previous year’s taxes if in the previous year they

NSW Health & immunisation

www.health.nsw.gov.aumedical exemption or natural immunity will be listed near the bottom of the updated AIR Immunisation History Statement. For older children who have had all of their immunisations, their Statement will include the words “This child has received all vaccines required by 5 years of age” at the bottom of the page. Updated Immunisation History