And use tax agreement certificate of exemption

Found 4 free book(s)ST3, Certificate of Exemption

www.revenue.state.mn.usForm ST3, Certificate of Exemption Purchaser: Complete this certificate and give it to the seller. Seller: If this certificate is not completed, you must charge sales tax. Keep this certificate as part of your records. This is a blanket certificate, unless one of the boxes below is checked.

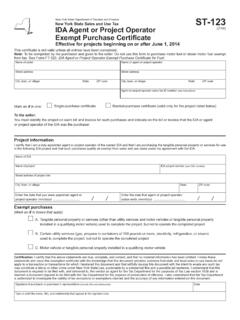

New York State Department of Taxation and Finance New …

www.tax.ny.govtax. Misuse of this certificate Misuse of this exemption certificate may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due. These include: • A penalty equal to 100% of the tax due; • A $50 penalty …

WT-4 Employee's Wisconsin Withholding Exemption ...

www.asphelpdesk.comINCREASES. will incur income tax liability for the year or (2) on or before December 1 if you anticipate you will incur Wisconsin income tax liabilities for the next year. If you want to stop or are required to revoke this exemption, you must file a new Form WT-4 with your employer showing the number of withholding exemption you are entitled to ...

M-5014 Exempt Organization Certificate

www.state.nj.usmember may not use an Exempt Organization Certificate and must pay sales tax. Example: The executive committee of a regis-tered exempt New Jersey fire company holds its annual dinner meeting in a local hotel. The group may use an Exempt Organization Certificate and pay no sales tax on the cost of the dinner and rooms paid for by the exempt ...