Bulletin 21 4 Virginia Department Of Taxation

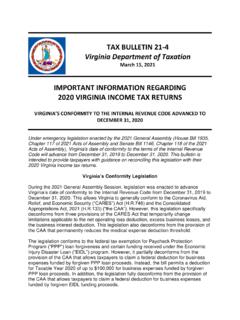

Found 3 free book(s)TAX BULLETIN 21-4 Virginia Department of Taxation

www.tax.virginia.govMar 15, 2021 · Virginia Tax Bulletin 21-4 March 15, 2021 Page 2 The legislation also provides an individual and corporate income tax subtraction for Taxable Year 2020 for up to $100,000 of all grant funds received by a taxpayer under the Rebuild Virginia program. This bulletin explains the conformity adjustments that may be necessary as a result of

TAX BULLETIN 22-1

www.tax.virginia.govRebuild Virginia grant recipients to Taxable Year 2019. This allows fiscal year filers to benefit from the deduction and subtraction for such expenses and income received during 2020 that was reflected on their Taxable Year 2019 returns. See Tax Bulletin 21‐4 and the Department’s website for information

State Guidance Related to COVID-19: Telecommuting Issues ...

www.hodgsonruss.comCOVID-19 the Department will not consider such telecommuting as creating nexus." (Email on File with Checkpoint Catalyst, 05/21/2020.) The Arizona DOR also replied that the agency "has determined that ingeneral, there is no requirement to waive nexus" for transaction privilege tax purposes. The agency takes the position that "for purposes