Certificate of foreign intermediary

Found 5 free book(s)Department and the IRS released Notice 2017-46

www.irs.govForm W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States. Form W-8EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting. Form W-8IMY, Certificate of Foreign Intermediary,

Instructions for Form W-8BEN (Rev. October 2021)

www.irs.govsuch as an intermediary, agent, or partnership, for the benefit of the beneficial owner. In addition, section 1446(a) requires a partnership conducting a trade or business in the United States to withhold tax on a foreign partner's distributive share of the partnership's effectively connected taxable income. Also,

Client Verification Documentation (KYC Checklist)

www.investec.comCertificate of change of name (if applicable). FSC licence and latest annual receipt: GBL1 and GBL2 only (Mauritian companies only). Register of members. 3.12.2 Trusts, the following documents are required:- The Trust Deed or Declaration of Trust and any other subsequent Deeds Certificate of registration if applicable

Product and Pricing Strategies

courses.aiu.edufrom foreign and domestic competitors, Bic expanded its line of pens and shavers. Bic added a roller pen after Mitsubishi Pencil Company introduced metal-point roller pens to the United States and gained 10 percent of the pen market. Bic's shaver sales dropped 5 percent after Gillette introduced the Microtrac razor.

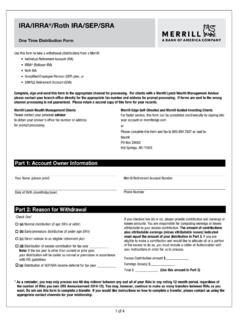

/Roth IRA/SEP/SRA MERRILL~-

olui2.fs.ml.comIf you are a U.S. citizen with a foreign address, you may not waive the Federal withholding requirement. If you are a Non-Resident Alien, all distributions are subject to a tax treaty rate or 30% tax withholding and you must complete Form W-8BEN. A …