Corporation Income Tax Declaration

Found 8 free book(s)Instructions for C and S Corporation Income Tax Returns

dor.sc.gov† To avoid a declaration penalty for underpayment of Corporate Tax, a corporation filing its first South Carolina Corporate Tax return or having federal taxable income of $1 million or more in any of the previous three tax years

REAL ESTATE TAX RETURN DECLARATION OF ESTIMATED …

revenuefiles.delaware.govReal Estate Tax Return Declaration of Estimated Income Tax Instructions Every non-resident individual, pass through entity or corporation who makes, executes, delivers, accepts, or presents for recording any document, except those exemptions defined or described in Sections 1126, 1606 and 1909 of Title 30, or in whose behalf any document is

1120X Amended U.S. Corporation Income Tax Return

www.irs.govIf the corporation’s return is being amended for a tax year in which the corporation participated in a “reportable transaction,” attach Form 8886, Reportable Transaction Disclosure Statement. If a reportable transaction results in a loss or credit carried back to a prior tax year, attach Form 8886 for the carryback years.

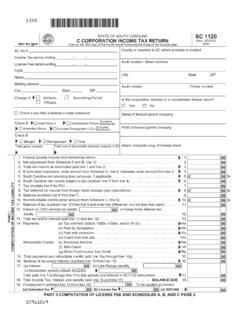

SC 1120 C CORPORATION INCOME TAX RETURN - South …

dor.sc.govschedule c summary of income tax credits (from sc1120tc) 1. Credit carryover from previous year's SC1120, Schedule C (should match SC1120TC Column A, line 13) . . . . . . .

IT-ELEC-03-G01 - How to complete the company Income Tax ...

www.sars.gov.zacompany income tax return 4 3.1 new look 4 3.2 requesting the return 5 3.3 getting started 6 completion of the itr14 return wizard 9 4.1 completing the “company/close corporation information” section 9 completion of itr14 return 17 5.1 tax …

MCQs on Basic Concept of Income Tax, Residential Status ...

gsck.ac.inHighest Administrative Authority for Income Tax in India is . (a) Finance Minister (b) CBDT (c) President of India (d) Director of Income Tax Q5. Income-tax Act, 1961 applies to . (a) Whole of India (b) Whole of India excluding J&K (c) Maharashtra (d) All of the above Q6. The basic source of income-tax law is .

UNITED STATES - MEXICO INCOME TAX CONVENTION

www.irs.govThe income tax Convention, the first between the two countries, is intended to reduce the distortions (double taxation or excessive taxation) that can arise when two countries tax the same income, thereby enabling United States firms to compete on a more equitable basis in Mexico and enhancing the

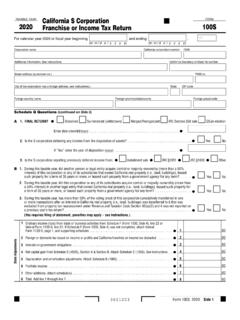

2020 Form 100S California S Corporation Franchise or ...

www.ftb.ca.gov3611203 Form 100S 2020 Side 1 B 1. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation or any of its subsidiaries that owned California real property (i.e., land, buildings), leased