Example: barber

Declarable Circumstances Form

Found 2 free book(s)Information for employers - Home | WorkSafe.qld.gov.au

www.worksafe.qld.gov.auThe Australian Taxation Office (‘ATO’) recognises these payments are a form of remuneration paid to the employee. Accordingly, the employer is required to declare all benefits provided and pay Fringe Benefits Tax (‘FBT’) on them. Declarable wages must include fringe benefits as defined in the ... Under the circumstances that an employer ...

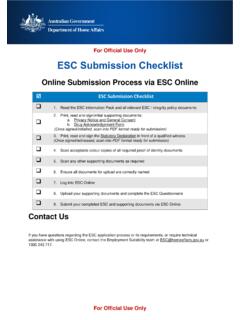

ESC Submission Checklist - Home Affairs

www.homeaffairs.gov.auThe Declarable Associations Policy provides guidance on the requirement to report declarable associations. ... complete your Online Employment Suitability Clearance form. ... for a confidential discussion regarding your circumstances at ESC@homeaffairs.gov.au or 1300 243 717.