Declaration Of Estimated Income Tax

Found 9 free book(s)Form N-1 Rev 2017 Individual Declaration of …

files.hawaii.govFORM STATE OF HAWAII DEPARTMENT OF TAXATION N-1 Declaration of Estimated Income Tax for Individuals 2018. 2017)(REV GENERAL INSTRUCTIONS NOTE: If any due date falls on a Saturday, Sunday, or legal holiday, use the next regular workday.

Instructions for NJ-1040ES 2017 - Estimated Tax …

www.state.nj.us-ES 2017 orm NJ1040ES 1 General Information Estimated tax means the amount that you estimate to be your income tax for the tax year after subtracting withholdings and other credits. If your estimated tax is more than $400, you are

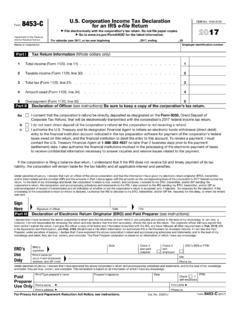

8453-C U.S. Corporation Income Tax Declaration

www.irs.govForm 8453-C Department of the Treasury Internal Revenue Service U.S. Corporation Income Tax Declaration for an IRS e-file Return File electronically with the corporation's tax …

FORM NO. 60 - Income Tax Department

www.incometaxindia.gov.inIncome-tax Rules, 1962 FORM NO. 60 [See second proviso to rule 114B] Form for declaration to be filed by an individual or a person (not being a company or

1041 U.S. Income Tax Return for Estates and Trusts …

www2.csudh.edu661113 Final K-1 Amended K-1 Schedule K-1 2016 OMB No. 1545-0092 (Form 1041) Part III Beneficiary's Share of Current Year Income, Department of the Treasury For calendar year 2016, Deductions, Credits, and Other Items Internal Revenue Service or tax year beginning , 2016, 1 Interest income 11 Final year deductions and ending , 20

CITY OF STRUTHERS INCOME TAX CASH 6 ELM …

www.cityofstruthers.comFILE WITH FOR TAX OFFICE USE ONLY CITY OF STRUTHERS INCOME TAX 6 ELM STREET STRUTHERS, OHIO 44471 PHONE: (330) 755-2181 FAX: (330) 755-2916 Web: www.cityofstruthers.com YEAR

Mississippi Resident Individual Income Tax Return ...

www.dor.ms.govMississippi Resident Individual Income Tax Return 2016 Page 2 801051682000 Form 80-105-16-8-2-000 (Rev. 4/16) SSN Column A (Taxpayer) Column B (Spouse)

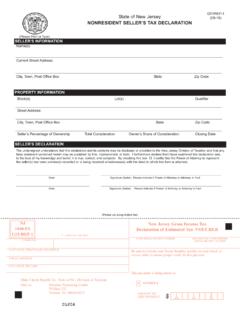

NONRESIDENT SELLER’S TAX DECLARATION - New …

www.state.nj.usNonresident Seller’s Tax Declaration Instructions A nonresident individual, estate, or trust that is selling or transferring property in New Jersey …

CITY OF CINCINNATI INDIVIDUAL INCOME TAX …

www.municonnect.comTitle: Microsoft Word - 2012 Individual Return revised 10222012.doc Author: sabbott Created Date: 12/11/2012 5:29:00 PM

Similar queries

Declaration of, Declaration of Estimated Income Tax, Estimated tax, INCOME TAX, Corporation Income Tax Declaration, Internal Revenue Service, Income, Declaration, Income Tax Return for Estates and Trusts, Mississippi Resident Individual Income Tax, Tax Declaration, New Jersey, CITY OF CINCINNATI INDIVIDUAL INCOME TAX