Estate Tax Return Of Nonresident Or United

Found 9 free book(s)Instructions for Form IT-205 Fiduciary Income Tax Return ...

www.tax.ny.govto file a New York State return, the Yonkers tax liability is based upon the New York State tax liability and must be reported on the state return as explained in the Yonkers instructions beginning on page 16. The fiduciary of a New York nonresident estate or trust or part-year resident trust must file a return on Form IT-205 if the estate or ...

2021 Form 1040-ES (NR) - IRS tax forms

www.irs.govForm 1040-NR, U.S. Nonresident Alien Income Tax Return, for details on income that is taxable. Estimated tax for an estate or trust. If you are using this package to figure and pay estimated tax for a nonresident alien estate or trust, use the 2020 Form 1040-NR as a guide in figuring the estate's or trust's 2021 estimated tax. You may

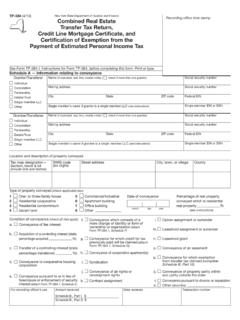

TP-584 New York State Department of ... - Record and Return

recordandreturn.comPage 2 of 4 TP-584 (4/13) Part III – Explanation of exemption claimed on Part I, line 1 (check any boxes that apply) The conveyance of real property is exempt from the real estate transfer tax for the following reason: a. Conveyance is to the United Nations, the United States of America, the state of New York, or any of their instrumentalities,

NJ Transfer Inheritance and Estate Tax

www.state.nj.usreturn of contributions or benefit payable by the Government of the United States pursuant to the Civil Service Retirement Act, Retired Serviceman’s Family Protection Plan and the Survivor Benefit Plan to a beneficiary or beneficiaries other than the estate or the executor or administrator of a decedent are exempt. 10.

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govNonresident individuals, estates, and trusts should take into account the amount of estimated tax paid with Form IT-2663 when they file their 2021 New York State income tax return. Any tax refund that is due can be claimed at that time. Estimated tax payments made with Form IT-2663 cannot be refunded prior to the filing of an income tax return.

2021 Form CT-706 NT Instructions Connecticut Estate Tax ...

portal.ct.govConnecticut Estate Tax Return (for Nontaxable Estates) General Information For decedents dying during 2021, the Connecticut estate tax exemption amount is $7.1 million. Therefore, Connecticut estate tax is due from a decedent’s estate if the Connecticut taxable estate is more than $7.1 million. The Connecticut taxable estate is the sum of:

Partnership Filing Fee and Nonresident Partner Tax

www.state.nj.usThe tax rate is 6.37% for nonresident noncorporate partners (e.g., individuals, trusts, and estates), and 9% for nonresident corporate partners of the allocable share of entire net income. FORMS The partnership must remit the nonresident partner tax with the Corporation Business Tax Partnership Payment Voucher (NJ-CBT-V).

Form W-9 Request for Taxpayer - United States Court of ...

www.ca7.uscourts.govWithholding of Tax on Nonresident Aliens and Foreign Entities). Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions

A Guide to Kentucky Inheritance and Estate Taxes

revenue.ky.govEstate Tax Since January 1, 2005, there has been no Kentucky estate tax. The American Taxpayer Relief Act was signed into law on January 2, 2013 and permanently extends the deduction for state estate taxes on the Federal 706. Before 2005, a credit was allowed against the federal estate tax for state estate, inheritance, legacy, or succession taxes.