Estate Tax Waiver Notice

Found 10 free book(s)APPLICATION TO RELIEVE ESTATE FROM ADMINISTRATION …

probate.cuyahogacounty.usWAIVER OF NOTICE . The undersigned surviving spouse, heirs at law, legatees, devisees and other persons entitled to notice of the filing of the application to relieve decedent’s estate from administration, waive such notice.

Affidavit Requesting Preliminary Waivers: Resident ...

www.state.nj.us• If requesting a real estate waiver, include deed, contract of sale, or closing agreement. Note: The filing of this form does not guarantee that any waivers will be issued at this time. In addition, the filing of this form will not generate a Notice of Assessment or any finding of tax due.

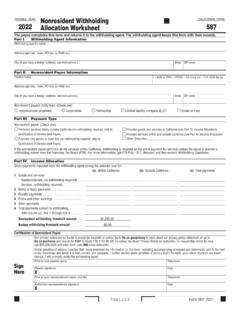

2022 Form 587 Nonresident Withholding Allocation Worksheet

www.ftb.ca.govwithholding waiver from the Franchise Tax Board (FTB). For more information, get FTB Pub. 1017, Resident and Nonresident Withholding Guidelines. ... (LLC) • Estate or trust ... To request this notice by mail, call 800.338.0505 and enter form code . 948. when instructed. Under penalties of perjury, I declare that I have examined the ...

2021 Income Tax for FORM CT-1041 Return Instructions

portal.ct.govWaiver of Penalty 13 ... Income tax trust and estate filers can now use myconneCT to file tax returns, make payments, view filing history, and ... Transfer Tax Return. See Special Notice 2003 2003(11), Legislation Affecting the Controlling Interest Transfer Tax. ...

Publication 1035 Extending the Tax Assessment Period

www.irs.govwritten waiver of this notice requirement, the two-year period runs from the date the waiver is filed. A waiver is generally executed on Form 2297, Waiver of Statutory Notice of Claim Disallowance). We will consider a claim for abatement of the assessment of c e r t a i n employment taxes or certain

The New Medi-Cal Recovery Laws - CANHR

www.canhr.orgnotice of Medi-Cal Recovery claim, the state cannot recover, and a claim is forever barred. The child does not need to be living with the Medi-Cal recipient or be an heir to the estate. This is current law and was not changed by the new statutes. Estate Recovery Limited to Probate Estate

Beneficiary Designation Form

retirementsolutions.financialtrans.comNaming Your Estate: If you designate your estate as the beneficiary you must indicate on the beneficiary form “PAY TO THE ESTATE OF…”. You should contact a tax or estate planner before designating your estate as your designated beneficiary. Naming a Trust: If you designate a revocable or irrevocable trust as your beneficiary, please include the trust’s name and …

CALIFORNIA CALIFORNIA RESIDENTIAL PURCHASE …

media.sdar.comREMOVAL OR WAIVER OF CONTINGENCY: Any contingency in L(1)-L(7) may be removed or waived by checking the applicable box above or attaching a Contingency Removal (C.A.R. Form CR) and checking the applicable box therein. Removal or Waiver at time of offer is against Agent advice. See paragraph 8H. n CR attached

2022 Nonresident Withholding Waiver Request

www.ftb.ca.govOnce expired, the payee must have the most current California tax return due on file or estimated tax payments for the current taxable year in order to have a new waiver granted. E Other – Attach a specific reason and include substantiation that would justify a …

2021 Instructions for Form 8941 - IRS tax forms

www.irs.govFor tax years beginning after 2013, the credit period during which the credit can be claimed is a 2-consecutive-tax-year period beginning with the first tax year in which: • An eligible small employer (or any predecessor) files an income tax return with an attached Form 8941 with line A checked “Yes” and a positive amount on line 12, or •