Exemptions And Credits Are Included

Found 9 free book(s)2020 CONNECTICUT INCOME TAX TABLES ALL EXEMPTIONS …

portal.ct.govall exemptions and credits are included. 2020 connecticut income tax tables all exemptions and credits are included ...

Sales and Use Taxes: Exemptions and Exclusions

www.cdtfa.ca.govOther Exemptions, Exclusions, or Credits. In addition to identifying the exemptions and exclusions, ... The placing of exemptions and exclusions into categories is in many instances subjective. Many ... following items are specifically included in the definition of “medicine’’ for sales and use tax purposes: -

Provincial Sales Tax (PST) Bulletin

www2.gov.bc.caFor more information on refunds and credits, see . Bulletin PST 400, PST Refunds. ... For exemptions that do not require the collector to obtain documentation from customers but ... applicable exemption certificate is included.

EXEMPTIONS, DEDUCTIONS AND CREDITS Claimed against …

www.nmlegis.govEXEMPTIONS Gross Receipts Tax (GRT), Compensating Tax (Comp) and ... included in or produced by the service provided 7 7-9-57 GR Sale of services to an out-of-state buyer who delivers an NTTC or other evidence of place of initial use ... CREDITS July 2012.

TAX BENEFITS AND CREDITS Living and Working with ...

www.irs.govquestions about these credits and benefits you can call 1-800-829-1040. If you use TTY/TDD equipment, call 1-800-829-4059 to order forms and publications and to ask tax questions. y. Publication 907, Tax Highlights for Persons with Disabilities y. Publication 501, Exemptions, Standard Deduction, and Filing Information y. Publication 535 ...

The Use of Modified Adjusted Gross Income (MAGI) in ...

sgp.fas.orgDec 06, 2018 · purposes. Medicare premiums, the individual mandate exemptions and penalties, eligibility and amounts for tax credits for health insurance exchange coverage, and Medicaid eligibility are determined, in part, using modified adjusted gross income (MAGI). MAGI is a concept that is used throughout federal tax law and certain federal programs.

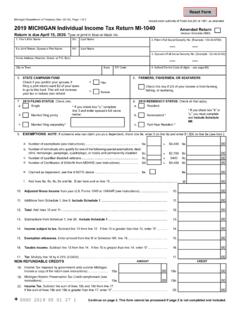

2019 Michigan Individual Income Tax Return MI-1040

www.michigan.govEXEMPTIONS. NOTE: If someone else can claim you as a dependent, check box 9e, enter 0 on line 9a and enter $1,500 on line 9e (see instr.). a. Number of exemptions (see instructions) 9a. x $4,400. b. Number of individuals who qualify for one of the following special exemptions: deaf,

Publication 510 (Rev. July 2021) - IRS tax forms

www.irs.govtax credits and refunds. For information on fuel credits against income tax see the instructions for Form 4136, Credit for Federal Tax Paid on Fuels, Form 6478, Biofuel Producer Credit, and Form 8864, Biodiesel and Renewable Diesel Fuels Credit. Comments and suggestions. We welcome your comments about this publication and your

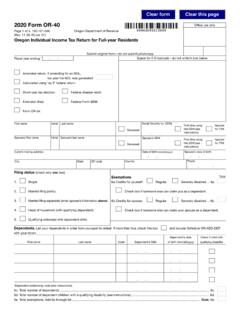

2020 Form OR-40 Office use only - Oregon.gov

www.oregon.gov22. Total tax before credits. Add lines 20 and 21 ..... 22. Standard and carryforward credits 3.2 Exemption credit. If the amount on line 7 is $100,000 or …