Fee Exemptions

Found 8 free book(s)itizenship fees 12i - Home Affairs

immi.homeaffairs.gov.auFee exemptions** Nil. Form 1290. Application for Australian citizenship – Other situations. $300 Fee concession* $35 Child/children under 16 years applying on the same form as a parent Nil Fee exemptions** Nil * Fee concessions for forms 1300t and 1290. A fee concession is payable by: • holders of a Pensioner Concession Card issued by

A guide to Property Tax Exemptions for SC Veterans,

dor.sc.govExemptions for a Surviving Spouse • One vehicle registered solely in surviving spouse’s name. • Home exemption if at the time of veteran’s death the surviving spouse acquires sole ownership in fee or for life from the deceased veteran. Medal of Honor Recipients and POWs Medal of Honor Recipients and POWs qualify for:

Sales Tax Exemptions for Nonprofit Organizations

www.revenue.wi.govThere are exemptions from sales tax for the following admissions sold by nonprofit organizations: • Admissions to participate in any sports activity in which more than 50% of the participants are 19 years old or younger (e.g., participation fees paid to a nonprofit organization to play in a youth soccer league).

Tax Exempt & Government Entities Group Exemptions

www.irs.govA central organization submits its application for exemption, the request for a group exemption and the required user fee as directed in the most recent revenue procedure on Exempt Organizations determination letters on exempt status (Rev. Proc. 2019-5, updated annually). Publication 4573 (Rev. 10-2019) Catalog Number 49351Q

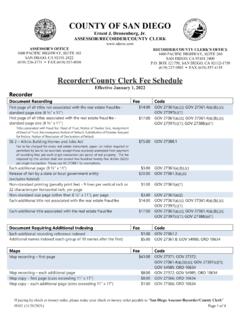

COUNTY OF SAN DIEGO

arcc.sdcounty.ca.govof recording fees, per each single transaction per parcel of real property. The fee imposed by this section shall not exceed two hundred twenty-five dollars ($225) per single transaction. Please see GC 27388.1 for exemptions. Each additional page (8 ½” x 11”) $3.00 GOV 27361(a),(b),(c) Release of lien by a state or local government entity

EXEMPT EMPLOYMENT

edd.ca.govBefore applying the above exemptions or to obtain further information about exempt employees and services, employers should contact the Taxpayer ... through the EDD’s no-fee . payroll tax seminars (seminars. edd.ca.gov/payroll_tax_seminars) and online courses. The EDD is an equal opportunity employer/program.

Circuit Deed Fee Schedule - Judiciary of Virginia

www.vacourts.govState recordation tax (grantee), exemptions, and non-taxable. Grantee tax rate applied to greater of the consideration paid or the actual value of the property conveyed. 039 ≤ $10 million 18¢ per $100 value ... or flat fee of $2 per transaction; or the greater of …

U.S. Department of Labor Wage and Hour Division

www.dol.govfee basis) are exempt from the FLSA if they customarily and regularly perform at least one of the duties of an exempt executive, administrative or professional employee identified in the standard tests for exemption.