Fixed Assets Accounting

Found 8 free book(s)What are the 11 Basic Accounting Formulas?

www.easternct.eduFormula 2: Current Assets Current assets are the sum of assets that will convert into cash in less than 12 months. Current Assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses Formula 3: Net Fixed Assets Net fixed assets are the book value of fixed assets. Net Fixed Assets = Fixed Assets @ cost – Accumulated Depreciation Formula ...

Internal Audit Fixed Assets - NHS Lothian

org.nhslothian.scotthe public sector context, and includes the treatment of assets and liabilities within the accounts. The Board’s Standing Financial Instructions include accounting for fixed assets, in addition to management of an asset register and the security of assets.

Asset Management/Fixed Assets - SAP Support

sap.olemiss.eduR/3 Path > Accounting > Financial Accounting > Fixed Assets > Asset > Display > Asset [double-click] Transaction Code AS03 Asset Enter Asset number or use search button. Enter Press enter or left click on Enter icon. Display Info Tab through the folders. Left click on the tab you are interested in viewing.

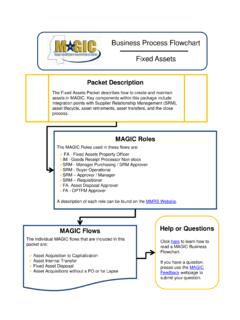

Business Process Flowchart Fixed Assets

www.dfa.ms.govFixed Assets Property Officers will have to collaborate with Purchasing and Accounting within their agency to ensure that the assets are created and reported correctly in the system. Asset master shell records will be created at the beginning of the purchasing

Accounting depreciation or capital allowances?

assets.publishing.service.gov.ukMost of these assets lose value as they are used – they “depreciate”. This commercial reality is reflected in a business’s financial accounts, which include the assets owned by the business and the depreciation on those assets. The tax regime recognises that investment in tangible fixed assets should be

Fixed Assets Inventory Procedures

wp-cdn.aws.wfu.eduFixed Assets Inventory Procedures INVENTORY Physical Inventory Overview Physical inventories are conducted to verify the accuracy of the University’s property records in the Banner Fixed Assets and Sage Fixed Assets Tracking modules, as well as the existence and activity status of the assets.

Accounting for and auditing of digital assets

us.aicpa.orgAccounting for and auditing of digital assets | i Notice to readers The objective of this practice aid is to develop nonauthoritative guidance on how to account for and audit digital assets under U.S. generally accepted accounting principles (GAAP) for nongovernmental entities and generally accepted auditing standards (GAAS), respectively.

ACCOUNTING CONCEPTS - Sinhgad

cms.sinhgad.edul On the basis of this concept, depreciation is charged on the fixed asset. l It is of great help to the investors, because, it assures them that they will continue to get income on their investments.