Foreign Tax Credit Corporations

Found 6 free book(s)Income or (Loss) Before Adjustments (Report all amounts in ...

www.irs.govForm 1118 (Rev. December 2015) Department of the Treasury Internal Revenue Service . Foreign Tax Credit—Corporations Information about Form 1118 and its separate instructions is at

TURKEY CORPORATE TAX (KURUMLAR VERGISI)

www.corptax.orgTURKEY CORPORATE TAX (KURUMLAR VERGISI) The basic rate of corporation tax for resident and non-resident companies in Turkey is 20%. Corporations in Turkey can be regarded as either limited or unlimited taxpayers.

TAX GUIDE 2017|2018

www.legalandtax.co.za- 1 - CONTENTS. INCOME TAX RATES 2 DIFFERENT TYPES OF ENTITIES TAX REBATES 2 Small business corporations 24 TAX THRESHOLDS 2 Personal service providers 26

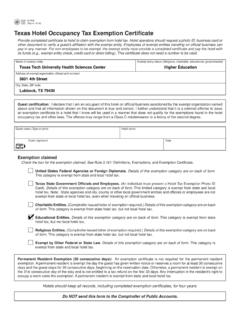

12-302 Hotel Occupancy Tax Exemption Certificate - TTUHSC

www.fiscal.ttuhsc.edu12-302 (Rev.4-14/18) Texas Hotel Occupancy Tax Exemption Certificate . Provide completed certi ficate to hotel to claim exemption from hotel tax.

AN OVERVIEW OF THE SPECIAL TAX RULES RELATED TO …

www.jct.gov1 INTRODUCTION This pamphlet1, prepared by the staff of the Joint Committee on Taxation, provides an overview of the special tax rules related to Puerto Rico and an analysis of the tax and economic policy implications of recent legislative options.

Instructions for Form 1118 (Rev. December 2017)

www.irs.govSeparate Category!