Full year resident income tax return

Found 9 free book(s)Full-Year Resident Income Tax Return

www.tax.ny.govIT-201-I Instructions Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return New York State • …

Full-Year Resident Income Tax Return

www.tax.ny.govIT-201-I Instructions Department of Taxation and Finance Instructions for Form IT-201 Full-Year Resident Income Tax Return New York State • New York CityYonkers •• MCTMT

Forms and instructions: Form OR-40 Schedule OR …

www.oregon.govApr 17, 2018 · 150-101-043 (Rev. 12-17) Full-year Resident Publication OR-40-FY www.oregon.gov/dor • April 17, 2018 is the due date for filing your return and paying your tax …

Resident, Nonresident or Part-Year Resident …

www.maine.govreturn. You must fi le an amended Maine income tax return if (1) you have fi led an amended federal income tax return that affects your Maine income

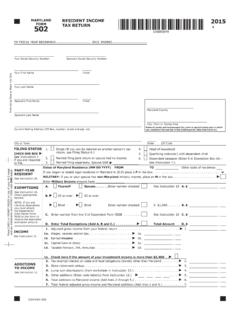

MARYLAND RESIDENT INCOME 502 TAX RETURN

forms.marylandtaxes.gov45. Balance due (If line 39 is more than line 44, subtract line 44 from line 39 . See Instruction 22 .)

RESIDENT, NON-RESIDENT AND PART-YEAR …

www.dor.ms.govform 80-100-16-8-1-000 (rev. 01/17) resident, non-resident . and . part-year resident . income tax instructions . 2016. individual income tax bureau. po box 1033

RESIDENT INCOME 2016 FORM TAX RETURN 502

forms.marylandtaxes.gov2016. Page 3. 45. Balance due (If line 39 is more than line 44, subtract line 44 from line 39. See Instruction 22.) ..... 45.

STATE OF ARKANSAS Amended Individual Income …

www.arkansas.govGENERAL INSTRUCTIONS If you need to adjust your Arkansas Income Tax Return, you must complete either the AR1000A or the AR1000ANR Amended Form.

CITY OF CINCINNATI INDIVIDUAL INCOME TAX …

www.municonnect.comTOL CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS Office Phone: (513) 352-2546 Website: www.cincinnati-oh.gov/citytax Mail to: PO Box 637876, Cincinnati OH 45263-7876

Similar queries

Full-Year Resident Income Tax Return, Full, Year Resident, Return, Resident, Income tax return, Income, RESIDENT INCOME, TAX RETURN, RESIDENT, NON-RESIDENT AND PART-YEAR, Resident, non-resident . and . part-year resident, Income tax, STATE OF ARKANSAS Amended Individual Income, Arkansas Income Tax Return, CITY OF CINCINNATI INDIVIDUAL INCOME TAX, CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN