Home Location

Found 7 free book(s)User Guide - HP Home Page

h10032.www1.hp.comThe Home screen provides a central location where you can access information and email, browse the Web, stream videos, view photos, and access social media websites. NOTE: The appearance of the Home screen may vary. Swipe down from the top to display notifications.

Mobile Home Real Estate Excise Tax Affidavit - Wa

dor.wa.govThe mobile home has substantially lost its identity as a mobile unit by virtue of : (a) being fixed in location upon land owed or leased by the owner of the mobile home, (b) being placed on a foundation (posts & blocks), and (c) having fixed pipe

COMMUNITY CARE LICENSING EMERGENCY DISASTER PLAN …

www.cdss.ca.gov6. EQUIPMENT LOCATION - Your home must contain a fire extinguisher and smoke detector device which meet the standards established by the State Fire Marshal. The fire extinguisher must be in a location that is easily accessible and identified in this plan. The local fire department may help you with the location of fire equipment.

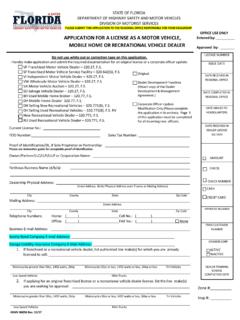

APPLICATION FOR A LICENSE AS A MOTOR VEHICLE, …

www.flhsmv.govquarters; and, except in the case of a mobile home broker, that the location affords sufficient unoccupied space to store all mobile homes and recreational vehicles offered and displayed for sale; andthat the location is a suitable place in which I can, in good faith, carry on business, maintain books, records, and files necessary to conduct ...

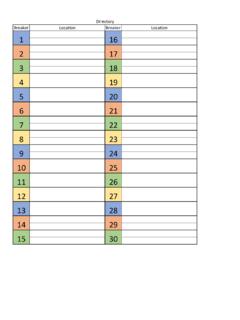

Directory Breaker Location Breaker Location 1 16 5 6 7 8 24

everydayoldhouse.comBreaker Location Breaker Location Directory 1 16 2 3 17 18 15 4 5 6 7 8 9 10 11 12 13 14 30. Author: jennifer osterhout Created Date: 4/4/2020 3:47:57 AM Title: Untitled

c; sides of paper. - NC

files.nc.gov1. Your home is maintained as the main household of a child or stepchild for whom you can claim a federal exemption; and 2. You were entitled to file a joint return with your spouse in the year of your spouse’s death. MARRIED TAXPAYERS - For married taxpayers, both spouses must agree

Publication 1321 (October 2021) Special Instructions For ...

www.irs.gov$11,000, real estate taxes $10,000, home mortgage interest of $16,250, and charitable deductions of $5,000 (cash contributions). You apportion deductions for your Federal tax return as follows: multiply the deduction to be allocated by a fraction. The numerator of the