How To Complete The Company Income Tax

Found 7 free book(s)IT-ELEC-03-G01 - How to complete the company Income …

www.sars.gov.zathe completion, submission and management of the Company Income Tax Return (ITR14) via eFiling. This document must be read in conjuction with the following External Guide - How to complete the Income Tax Return(ITR14) for Companies. INTRODUCTION Corporate Income Tax (CIT), also known as business tax, is a tax imposed on businesses

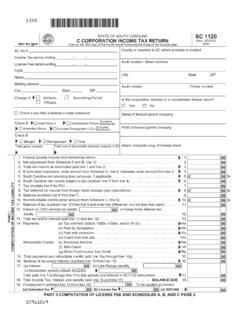

SC 1120 C CORPORATION INCOME TAX RETURN

dor.sc.govPART I COMPUTATION OF INCOME TAX LIABILITY 30911069 (Complete Schedule M) - - - - Amended Return Check if: Attach complete copy of federal return ... Name of federal parent company. 20. Total capital and paid in surplus (multi-state corporations see …

2018 Form 568 - Limited Liability Company Return of Income

www.ftb.ca.govLimited Liability Company Return of Income CALIFORNIA FORM 568 For calendar year 2018 or fiscal year beginning and ending . (m m / d d / y y y y) (m m / d d / y y y y) RP Limited liability company name (type or print) A California Secretary of State (SOS) file number Additional information B FEIN

2020 FORM 568 Limited Liability Company Return of Income

www.ftb.ca.gov3671203 Form 568 2020 Side 1 Limited Liability Company Return of Income I (1) During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this LLC or any legal entity in which the LLC holds a controlling or majority interest that owned California real property

Corporate Income Tax MICHIGAN 2020

www.michigan.govComplete Federal Tax Forms First Beforepreparing CIT returns, complete all federal tax forms. Theseforms may include: • CCorporations— U.S. Form 1120 and Schedules D, K, 851, 940,4562, 4797, and 8825. • Limited Liability Companies (LLCs) — Federal forms listedabove if LLC filesas a C Corporationfor federal return purposes.

FORM OF RETUN OF INCOME UNDER THE INCOME TAX IT …

nbr.gov.bd7 Income of the spouse or minor child as applicable : u/s 43(4) 8 Capital Gains : u/s 31 9 Income from other source : u/s 33 10 Total (serial no. 1 to 9) 11 Foreign Income: 12 Total income (serial no. 10 and 11) 13 Tax leviable on total income 14 Tax rebate: u/s 44(2)(b)(as per schedule 3)

HOW TO PREPARE YOUR RETURN FOR MAILING - IRS tax …

www.irs.govcomplete and accurate. Avoid mistakes that may delay your refund or result in correspondence with the IRS. Here are just a few items to complete prior to mailing your tax return: Sign your return. Your federal tax return is not considered a valid return unless it is signed. If you are filing a joint return, your spouse must also sign.