Iii Stamp Duty And Registration Fee

Found 10 free book(s)Sr. Deed Name Stamp Duty Registration Fee Facilitation ...

revenue.punjab.gov.inDocument wise detail of Stamp Duty, Registration Fee and Facilitation charges Sr. No Deed Name Stamp Duty Registration Fee Facilitation charges PIDB 1 Sale/ Gift 5% of the Consideration amount + 1 % of SIC (Social Infrastructure Cess) 1 % of the Consideration amount (Max. Rs. 2 lac ) Rs.1000/- (for Consideration amount upto

Information published as per Act 4(1)(b) of The Right to ...

www.tn.gov.in• The Website enables you to ascertain the stamp duty / registration fees payable for a particular property transaction. OR • Ascertain the guideline value of the property and the stamp duty, registration fees etc, to be paid for a document from the Registering officer.

Table of Contents

www.mca.gov.inPart III - Important Points for Successful Submission ... require that the stamp duty payable thereon be adjudicated under section 31 of the Indian Stamp Act, 1899. ... shall be filed with the Registrar with fee as provided in Companies (Registration Offices and Fees) Rules, 2014 and where the company is listed, with the Securities and Exchange ...

C2 STAMP DUTY - Malaysian Institute of Accountants

www.mia.org.my(iii) For projects that are cancelled by the parties who had offered the contracts, and stamp duty for all such contracts had been paid, only the stamp duty at the Ad valorem rate will be refunded. Stamp duty at the fixed rate of RM50.00 will not be refunded. The remission of stamp duty is effective from 15 July 2009.

THE KARNATAKA STAMP ACT, 1957

karunadu.karnataka.gov.inpaper bearing the impressed stamp.] (2) The Mysore General Clauses Act, 1899, shall apply for the interpretation of this Act, as it applies for the interpretation of a Karnataka Act. 1. Clause (r) inserted by Act No.1 of 2008 CHAPTER II Stamp Duties A. - Of the Liability of Instruments to duty. Instruments chargeable with duty. 3.

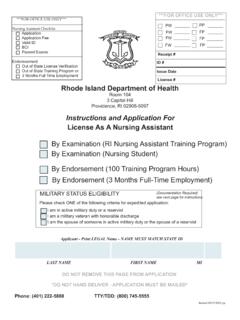

BCI Passed Exams Receipt # ID # Issue Date License # Rhode ...

health.ri.govI am the spouse of someone in active military duty or the spouse of a reservist ... BCI (Background Check) with stamp and seal from the RI Attorney General’s Office . only, For informa- ... (i.e., Jr., Sr., II, III) Name(s) under which originally licensed in this or another state, if different from above (First, Middle, Last). ...

CLOSE CORPORATIONS ACT 69 OF 1984 October 04

www.cipc.co.zaRegistration Office and register 3.(1) For the registration of corporations under this Act there shall be an office in Pretoria called the Close Corporations Registration Office. (2) Registers of names and registration numbers and such other matters concerning corporations as may be prescribed, shall be kept in the Registration Office.

CHAPTER 50:03 VALUE ADDED TAX

www.burs.org.bwPART III Rules relating to Supplies 8. Time of supply 9. Value of supply 10. Zero rating 11. Exempt supply PART IV Imports 12. Time of import 13. Value of import 14. Exempt import 15. Import declaration and payment of tax PART V Registration 16. Registration 17. Application for registration 18. Cancellation of registration PART VI Calculation ...

CHAPTER 5 EXPORT PROMOTION CAPITAL GOODS (EPCG) …

content.dgft.gov.in(ii) Value of duty saved allowed under the authorisation. (iii) Description of product to be exported and value of export obligation. (c) Authorisation holder shall maintain a register of stock & consumption of capital goods covered under sub- paragraphs (a) (iii) and (iv) of paragraph 5.01 of FTP imported under the

CHAPTER 5 EXPORT PROMOTION CAPITAL GOODS (EPCG) …

content.dgft.gov.in(ii) Value of duty saved allowed under the authorisation. (iii) Description of product to be exported and value of export obligation. (c) Authorisation holder shall maintain a register of stock & consumption of capital goods covered under sub- paragraphs (a) (iii) and (iv) of paragraph 5.01