Individual Income Tax Instructions

Found 6 free book(s)2020 District of Columbia (DC) Individual Income Tax Forms ...

otr.cfo.dc.govDistrict of Columbia (DC) Individual Income Tax Forms and Instructions D-40 All Individual Income Tax Filers 2020 Revised 09/2020 • You may use MyTax.DC.gov to fi le and pay online for Forms D-40ES (estimated tax) and FR-127 (extension of time to fi le). • Payments can be made by ACH debit, credit/debit card, check or money order (US dollars).

K-40ES Individual Estimated Income Tax Vouchers and ...

ksrevenue.govK-40ES Individual Estimated Income Tax Vouchers and Instructions Rev. 7-20 Author: rvesfzs Subject: Estimated tax payments are required on income not subject to withholding, such as earnings from self-employment, unemployment, interest and dividends \(including income earned in another state while living in Kansas\). Created Date: 9/22/2020 9 ...

Publication 1321 (October 2021) Special Instructions For ...

www.irs.govMust File A U.S. Individual Income Tax Return (Form 1040 or Form 1040-SR) If you are a bona fide resident of Puerto Rico who will file a U.S. Federal Income Tax Return, Form 1040, and claim an exclusion for income earned in Puerto Rico, you will …

Individual Income Tax Instructions 2020

tax.idaho.govDec 21, 2020 · means all income you received in the form of money, property, goods and services that aren’t exempt from tax. It’s measured before subtracting allowable deductions. Gross income includes, but isn’t limited to: • Income from wages, salaries, tips, interest, and dividends that isn’t exempt from tax • Self-employment income before expenses

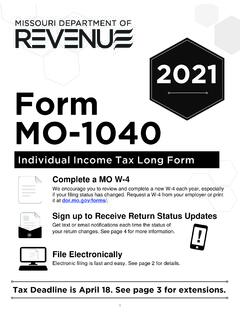

Form MO-1040 Book - Individual Income Tax Long Form

dor.mo.govAutomatic Extension of Time To File U.S. Individual Income Tax Return (Federal Form 4868) with your Missouri income tax return when you file. If you expect to owe Missouri income tax, file Form MO-60 with . your payment by the original due date of the return. Remember: An extension of time to file does not extend the time to pay.

Individual Income Tax - Kansas Department of Revenue

ksrevenue.govA Kansas resident for income tax purposes is anyone who lives in Kansas, regardless of where they are employed. An individual who is away from Kansas for a period of time and has intentions of returning to Kansas is a resident. If you were a Kansas resident for the entire year, you must file a Kansas individual income tax return if: 1) you