Mineral royalty

Found 4 free book(s)Colorado Revised Statutes 2019

leg.colorado.govmineral leases or interests therein or other severed mineral or royalty interests in real property, including easements, rights-of-way, permits, licenses, and any other interests in real property for or on behalf of a third party, for the purpose of, or facilities related to, intrastate and interstate

To claim property reported in the name of a deceased owner ...

www.sco.ca.gov11. If you are claiming Mineral Rights or Royalties, provide proof that the property belongs to the deceased owner. Suggested documents: A. Copy of royalty payment (check stub or copy of check) B. Division Order C. Copy of IRS Form 1099-MISC, statement of miscellaneous income earned D. Statement of Royalties (from the company) 12.

MINERALAND PETROLEUM RESOURCES DEVELOPMENT ACT - …

www.energy.gov.zaConsideration or royalty payable 12. Payment of compensation 13. Certain functions of Director: Mineral Development to be performed by Regional Manager or Minister TABLE 1 TABLE 2 TABLE 3 8 5 10 15 20 25 30 35 40. CHAPTER 1 DEFINITIONS Definitions 1. In this Act, unless the context indicates otherwise—

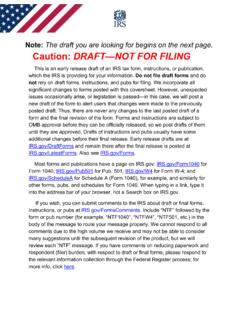

Note: The draft you are looking for begins on the next ...

www.irs.govNote: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information.