Mississippi State Tax Commission

Found 9 free book(s)INSTRUCTIONS FOR COMPLETING THE RESIDENT ... - …

www.mrec.ms.govThe undersigned, in making this application to the Mississippi Real Estate Commission for license to carry on the business of real estate Salesperson under the provisions of the Mississippi Real Estate Broker’s License Act of 1954, as Amended, swears (or affirms) that he or she has read and is thoroughly familiar with the

MUNICIPAL GOVERNMENT - Mississippi

www.sos.ms.govIn Mississippi, State law establishes different types of municipal governments, as described in Miss . Code Ann . Title 21 et seq . (1972) . In current practice, municipal government takes three basic forms organizing as either a mayor-council government, a commission government, or a council-manager government .

Start your business in Mississippi

www.sos.ms.govMississippi encourages foreign companies to do business in Mississippi. If your out-of-state company will be conducting business in Mississippi, you are likely required to register with the Secretary of State. If any of your employees will be in the State for a total of thirty (30) days in any given year, registration is required.

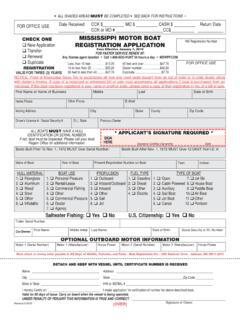

CHECK ONE MISSISSIPPI MOTOR BOAT New Application ...

www.mdwfp.comNOTICE: Proof of Mississippi Sales Tax to accompany all new and used boats bought from an out-of-state or in-state dealer along with dealer’s invoice. A copy of a notarized or witnessed bill of sale must accompany all applications if boat is purchased from an individual.

TCE Organization Name City State

www.irs.govTCE Organization Name City State Alaska Business Development Center Inc. Anchorage AK Volunteer Connections of Central Alabama Inc. Alexander City AL Etowah County Retired & Senior Volunteer Program Inc. Gadsden AL South Alabama Regional Planning Commission Mobile AL Western Arkansas Counseling & Guidance Center Inc. Fort Smith AR

Instructions for completing dealer app

www.dor.ms.govSales Tax Number City Zip County Code Legal Name SSN Primary Address (Number and Street, Including Rural Route) State Corporation Number of Full Time Employees Mississippi Application for Motor Vehicle Dealer License Partnership 761051581000 Form 76-105-15-8-1-000 (Rev. 07/15) New Appropriate Types FEIN Application for year beginning November 1 ...

State and Local Sales Tax Rates, 2021 - Tax Foundation

files.taxfoundation.orgTAX FOUNDATION | 3 State Rates California has the highest state-level sales tax rate, at 7.25 percent.2 Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Five states follow with 4

International Fuel Tax Agreement (IFTA) Application

revenue.louisiana.govCity, state, ZIP Make address changes in area provided on back and mark here. R-5678-L (2/02) State of Louisiana Department of Revenue International Fuel Tax Agreement (IFTA) Application Telephone (225) 219-7656 TDD (225) 219-2114 Application Fee: $35.00 Type of ownership: Individual Partnership Corporation Other

State Income Tax Benefits for Contributions to 529 Plans ...

cga.ct.govpost-tax basis, earnings grow tax-deferred, and withdrawals are tax-free if used for qualifying expenses. The state tax treatment of 529 plan and ABLE account earnings and withdrawals is generally the same as the federal treatment, but some states additionally provide state income tax benefits for contributions to encourage participation.