Nebraska Resale Or Exempt Sale Certificate

Found 5 free book(s)UNIFORM SALES & USE TAX …

giftcraftprod.azureedge.netA valid resale certificate is effective until the issuer revokes the certificate. 4. The state of Colorado, Hawaii, Illinois, and New Mexico do not permit the use of this certificate to claim a resale exemption for ... If a purchaser fails to provide a certificate of resale at the time of sale in Illinois, the ... Nebraska: A blanket ...

Nebraska and County Lodging Tax Return 64 • MMPs must ...

revenue.nebraska.govbe collected if the exempt entity makes payment via any other charge card, even if a Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption, Form 13 is provided. Federal Purchases. Purchases by the U.S. Government or its agencies must be supported with either a federal certificate of exemption or payment with a U.S. Treasury warrant.

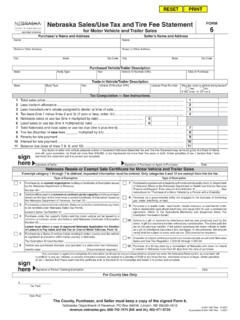

Nebraska Sales/Use Tax and Tire Fee Statement for Motor ...

revenue.nebraska.govNebraska Resale or Exempt Sale Certificate for Motor Vehicle and Trailer Sales. Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818. revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Exemption Certificate

dor.sd.govprovided an exemption certificate if ALL of the following conditions are met: 1. All fields on the exemption certificate are completed by the purchaser. 2. The fully completed exemption certificate is provided at the time of sale. 3. The state that is due the tax on the sale allows the exemption reason. 4.

Sales and Use Tax - Construction Contractors

www.salestaxhelp.comNebraska: Nebraska contractors must file a sales and use tax election (Form 16) stating whether they wish to pay tax as a retailer, a tax-paid consumer, or a consumer who buys materials and fixtures without tax and then pays use tax on inventory when it is withdrawn for contracts. The election is binding until another Form 16 is filed.