On Personal Income

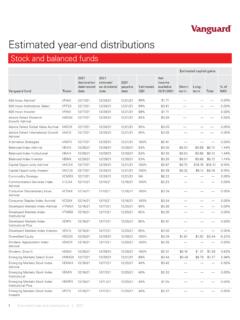

Found 8 free book(s)Estimated year-end distributions - personal.vanguard.com

personal.vanguard.comGlobal Wellesley Income Investor VGWIX 12/16/21 12/17/21 12/20/21 49% $0.11 — — — 0.00% 2 Estimated year-end distributions | 2021 Estimated capital gains

Personal services income for companies, partnerships and ...

www.ato.gov.auPERSONAL SERVICES INCOME FOR COMPANIES, PARTNERSHIPS AND TRUSTS 3. 01. WHAT PERSONAL SERVICES INCOME IS 5 Working out if the income your business . receives is personal services income (PSI) 6 Income that is PSI 7 Income that is not PSI 8 Does your business receive PSI? 9. 02. WORKING OUT IF THE PSI RULES APPLY 11 Overview 12 Step 1: The ...

Personal tax tip #51 - Marylandtaxes.gov

www.marylandtaxes.govAs of January 1, 2014, Maryland's graduated personal income tax rates start at 2% on the first $1,000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 ($300,000 if filing jointly). See . Maryland's Income Tax Rates and Brackets. How is the local income tax calculated?

PERSONAL INCOME TAX ACT - LawPàdí

www.lawpadi.comPERSONAL INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1. Imposition of tax. 2. Persons on whom tax is to be imposed. 3. Income chargeable. 4. Ge neral provisions as to valuation of benefits. 5. Va luation as to living accommodation. 6.

PERSONAL INCOME TAX PREPARATION GUIDE

www.revenue.pa.govThe Personal Income Tax Preparation Guide’s purpose is to provide volunteer preparers and Department of Revenue Field Office personnel with additional information and instructions for the preparation of the PA-40, Personal Income Tax Return. Although it may also be used by individual taxpayers who prepare their own PA-40, the prepa -

PERSONAL INCOME TAX WAGES REPORTED ON THE …

edd.ca.govinstructions for personal income tax forms. If you have access to the Internet, you may download, view, and print California income tax forms by accessing the FTB Web site at . www.ftb.ca.gov. The federal (IRS) toll-free number for assistance and ordering forms is (800) 829-1040. If you have access to

Personal Income Tax Bulletin 2009-02 -- Cancellation of ...

www.revenue.pa.govApr 30, 2009 · Personal Income Tax Bulletin 2009-4 for specific rules governing mixed-use business loan proceeds. You must report the cancellation of that portion of the credit card indebtedness as income if you used your credit card for …

W-4 Guide - Vanderbilt University

www.vanderbilt.eduThis includes all earnings combined for the tax year. If your income exceeds $1000 you could end up paying taxes at the end of the tax year. Please contact a tax advisor for more information. If you choose exemption you will be asked to complete another W-4 at the end of the year because it expires. You will be notified via email.