On Repair Of Tangible Personal Property

Found 8 free book(s)Sales and Use Tax on Repair of Tangible Personal Property

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Repair of Tangible Personal Property, Page 2 Maintenance or Service Warranty Contracts – A service warranty is “any contract or agreement for the cost of maintaining, repairing, or replacing tangible personal property.”

Michigan Department of Treasury Tax Compliance Bureau ...

www.michigan.govExample: Retailer (a home improvement store) purchases tangible personal property (e.g., shelves) and hires a contractor to affix that tangible personal property to the real estate in Michigan upon which the store is located.

2019 PERSONAL PROPERTY TAX FORMS AND …

www.kentonpva.com1 INSTRUCTIONS TANGIBLE PROPERTY TAX RETURNS (REVENUE FORMS 62A500, 62A500-A, 62A500-C, 62A500-L , 62A500-S1, 62A500-W and 62A500–MI) Definitions and General Instructions

Increase in De Minimis Safe Harbor Limit for Taxpayers ...

www.irs.gov- 3 - existing property, which otherwise must be capitalized under § 263(a). The de minimis safe harbor does not limit a taxpayer’s ability to deduct otherwise deductible repair or

Capitalization of Tangible Property - Internal Revenue …

www.irs.govaudit procedures..... 107 chapter 12 disposition concepts and macrs accounting rules..... 109 introduction.....

Personal Property Assessment and Taxation - oregon.gov

www.oregon.gov150-303-661 (Rev. 09-17) Personal property taxes become a lien on July 1 against any and all of the assessed property, as well as on per - sonal property assessed in the same category.

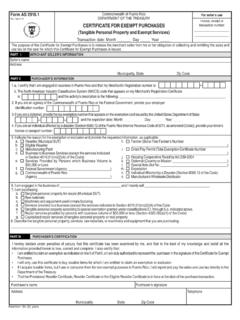

CERTIFICATE FOR EXEMPT PURCHASES transaction number ...

www.hacienda.gobierno.pr1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. INSTRUCTIONS Who must complete this form? This form must be completed by: A purchaser registered in the Merchant’s Registry ...

C E R T I F I C A T E O F R E S A L E - TVC Communications

www.sateng.comform e--590 (rev. 10--92) north carolina department of revenue sales and use tax division p. o. box 25000 raleigh, n. c. 27640--0001 c e r t i f i c a t e o f r e s a l e