Petroleum Tax

Found 4 free book(s)Form ST-125:6/18:Farmer's and Commercial Horse Boarding ...

www.tax.ny.govtax, the petroleum business tax, and the state and local sales tax on certain purchases. • Use Form FT-500, Application for Refund of Sales Tax Paid on Petroleum Products, to claim a refund of sales tax on certain purchases. Department of Taxation and Finance New York State and Local Sales and Use Tax Farmer’s and Commercial Horse Boarding

Arizona Form 5000 Transaction Privilege Tax Exemption ...

www.uline.comYour Name (as shown on page 1) Arizona Transaction Privilege Tax License Number 11. Electricity, natural gas or liquefied petroleum gas sold to a qualified manufacturing or smelting business. A manufacturing or smelting business that claims this exemption authorizes the release by the vendor of the information required to be

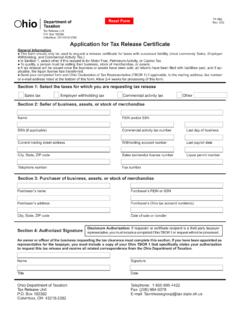

Department of Taxation

tax.ohio.govApplication for Tax Release Certificate. General Information This form should only be used to request a release certificate for taxes with successor liability (most commonly Sales, Employer. Withholding, and Commercial Activity Tax.) In Section 1, select other if this request is for Motor Fuel, Petroleum Activity, or Casino Tax.

Petroleum Industry Bill (PIB) 2021 - A Game Changer

assets.kpmgCGT Capital Gains Tax CIT Companies Income Tax CITA Companies Income Tax Act COVID-19 Coronavirus CPR Cost Price Ratio DOIBPSCA Deep Offshore and Inland Basin Petroleum Sharing Contracts Act DPR Department of Petroleum Resources ETR Estimated Tax Return FID Final Investment Decision FDI Foreign Direct Investment FG Federal Government FIRS ...