Plant Or Machinery Capital Allowances

Found 10 free book(s)INLAND REVENUE BOARD OF MALAYSIA QUALIFYING …

lampiran1.hasil.gov.my(a) tax treatment in relation to qualifying expenditure on plant and machinery for the purpose of claiming capital allowances; and (b) computation of capital allowances for expenditure on plant and machinery. 2. Relevant Provisions of the Law 2.1 This PR takes into account laws which are in force as at the date this PR is published.

INLAND REVENUE BOARD OF MALAYSIA DISPOSAL OF …

lampiran1.hasil.gov.mycapital allowances on that plant or machinery by computing a balancing allowance or a balancing charge. 5. Date of Disposal The date of disposal of an asset is the date when the asset is sold, discarded ... capital allowances brought forward and current year capital allowances for other assets were RM120,000, RM30,000 and RM55,000 respectively.

Part 09-02-05 - Tax Relief Scheme for Capital Expenditure on …

www.revenue.iemachinery or plant in respect of which capital allowances have been obtained, certain events, including the disposal of the plant or machinery, occur (section 288 TCA 1997).3 Section 288(3C) provides that a balancing charge is not made where expenditure was incurred on the provision of a specified intangible asset before 14

Departmental Interpretation And Practice Notes - No

www.ird.gov.hkSection 16G – Capital Expenditure on the Provision of a ... allowances under Part 6 of the Ordinance. 9. The term “domestic building or structureis defined in section 16F. ... Plastic manufacturing machinery and plant including moulds 28 Silk manufacturing machinery and plant 29 Sulphuric and nitric acid plant 31 .

Departmental Interpretation And Practice Notes - No

www.ird.gov.hk“machinery or plant” for the purposes of making depreciation allowances. The following points are pertinent in this regard. • Section 40(1) provides, inter alia, that “ “capital expenditure on the provision of machinery or plant” includes capital expenditure on alterations to an existing building incidental to

Oil and gas taxation in the UK Deloitte taxation and …

www2.deloitte.comCapital allowances (tax depreciation) rules that apply to all UK companies also apply to upstream companies. In addition, there are some specific rules: • first year allowances of 100% are available on qualifying expenditure incurred in the period of acquisition on plant and machinery (subject to a five year ‘use’ test) or mineral ...

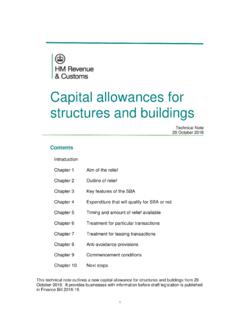

Capital allowances for structures and buildings - GOV.UK

assets.publishing.service.gov.ukThis differs from the treatment of communal areas for capital allowances for plant or machinery where assets used in such areas can qualify. Renovations and subsequent capital works 28. Capital expenditure undertaken on a structure or building after the date on which it enters into use will qualify for the SBA, but as a separate allowance.

CAPITAL ALOWANCES RATES FOR ASSETS

www.zra.org.zmPlant, Machinery and Equipment 25% Buildings i Industrial 5% Commercial 2% Investment allowance on ndu str ia lb g 10% F Initial allowance on industrial buildings 10% P ... Capital allowances apply to both tangible capital assets and intangible ones (like the purchase of a patent, for example.

Current and Deferred Tax Slides Tax Training PPT - Deloitte

www2.deloitte.comfive years. Taxpayers with huge capital investment had faced a risk of losing the benefit due to the short period of tax loss utilization • Pre-trading expenses • Repairs and maintenance • Lease rentals • Diminution in value of implement, utensil or similar article employed in production of gains or profits (plant and machinery not ...

ACT : INCOME TAX ACT 58 OF 1962 SECTION : SECTION 11(e

www.sars.gov.zadeduction for specific types of capital expenditureincurred in carrying on a trade , usually in the form of an allowance spread over a number of years based on the cost or value of an asset. Section11( e) is one such specific provision and provides for an allowance on the value of any machinery, plant, implements, utensils and articles used