Profits Tax Sole Proprietorship

Found 7 free book(s)Kentucky Tax Registration Application and Instructions

revenue.ky.gov(Sole Proprietorships, HCSRs, Qualified Joint Ventures, Estates, Governments, and Unincorporated Non-Profits SKIP question 14) 15–16. OWNERSHIP DISCLOSURE–RESPONSIBLE PARTIES (REQUIRED FOR ALL BUSINESS STRUCTURES)

4720 Return of Certain Excise Taxes Under ... - IRS tax forms

www.irs.govFor calendar year 2021 or other tax year beginning, 2021, and ending, 20 ... trust, joint venture, sole proprietorship, etc.) . . . (a) Voting stock (profits interest or beneficial interest) (b) Value (c) Nonvoting stock (capital interest) 1:

Basic License Application - New York City

www1.nyc.govLimited Liability Partnership Sole Proprietorship ... The Sales Tax Identification Number is the 9, 10, or 11-digit number on your New York State Department of Taxation and Finance Certificate of ... Non-Profits must provide information on all officers and all Board

Pub. KS-1216 Business Tax Application and Instructions Rev ...

www.ksrevenue.orga tax practitioner (accountant, enrolled agent, attorney, etc.) or one of the agencies listed in the Resource Directory on page 14 for information that can assist you in establishing your business structure. The following are the most common types of a business organization. • SOLE PROPRIETORSHIP . A sole proprietorship is a

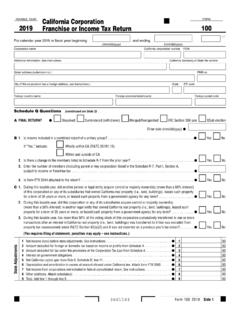

2019 Form 100 California Corporation Franchise or Income ...

www.ftb.ca.gov• (1) Sole proprietorship (2) Partnership (3) Joint venture (4) Corporation (5) Other (Attach statement showing name, address, and FEIN/SSN/ITIN of previous …

Small Business For use in preparing - IRS tax forms

www.irs.govSole proprietor. A sole proprietor is someone who owns an unincorporated business by himself or herself. You are also a sole proprietor for income tax purposes if you are an individual and the sole member of a domestic LLC un-less you elect to have the LLC treated as a corporation. Independent contractor. People such as doctors, den-

Instructions From Business Profit or Loss - IRS tax forms

www.irs.govemployer-tax-credits. Reminders Small Business and Self-Employed (SB/SE) Tax Center. Do you need help with a tax issue or preparing your return, or do you need a free publication or form? SB/SE serves taxpayers who file Form 1040, Form 1040-SR, Schedules C, E, F, or Form 2106, as well as small business taxpayers with assets under $10 million.