Real property exemption for nonprofit organizations

Found 5 free book(s)Nonprofit Organizations & Government Entities

www.state.nj.usTax Treatment of Nonprofit Organizations and Government Entities Rev. 6/13 6 Subsequent Transactions Once a seller has a copy of a valid Form ST-5 in its records, the ST-5 serves as proof of exemption for subsequent transactions for the same organization.

WISCONSIN PROPERTY TAX EXEMPTIONS - WAAO

www.waao.orgWISCONSIN PROPERTY TAX EXEMPTIONS A GUIDE FOR DETERMINING EXEMPTION STATUS Steven F Schwoerer City of Oshkosh Assessor’s Office 215 Church Avenue, Room 302

ALLOWABLE DEDUCTIONS A. Sales Tax B. Use Tax

www.michigan.gov(Form 3520). See RAB 2016-18. • Vehicle sales to non-reciprocal states for which no tax was paid to Secretary of State. • Qualified nonprofit organizations may take a deduction

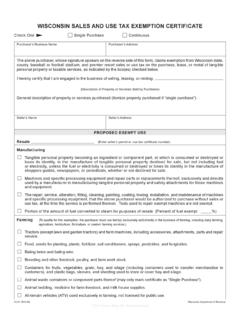

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

www.edist.comWISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE S-211 (R.9-00) Wisconsin Department of Revenue This Form May Be Reproduced Check One Single Purchase Continuous

Michigan Department of Treasury Tax Compliance Bureau ...

www.michigan.govMichigan Department of Treasury Tax Compliance Bureau August 2018 Page 2 of 139 Disclosure