Record Of Medical And Travel Expenses

Found 9 free book(s)OMB Number: 2900-0798 - Veterans Affairs

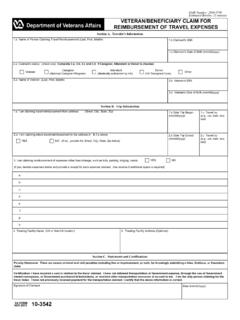

www.va.govREIMBURSEMENT OF TRAVEL EXPENSES . OMB Number: 2900-0798 Estimated Burden: 15 minutes. ... VA systems of records 24VA19 Patient Medical Record-VA, published in the Federal Register in accordance ... travel benefits may also be done in person at a VA health care facility. 4. Application for travel reimbursement must be done within 30 days of travel.

CLAIMANT'S RECORD OF MEDICAL AND TRAVEL …

www.wcb.ny.govmileage or other necessary expenses going to and from your health care provider's office or the hospital. To help you keep a record of such expenses we have provided this form. In order to help insure that you are properly reimbursed, list each item of expense below -- whether or not you obtained a receipt (wherever possible obtain receipts).

Tax Prep Checklist - H&R Block

www.hrblock.comAmounts of miles driven for charitable or medical purposes Expenses related to your investments Amount paid for preparation of last year’s tax return Employment-related expenses (dues, publications, tools, uniform cost and cleaning, travel) Job-hunting expenses Receipts for energy-saving home improvements Record of estimated tax payments made

BookSafe Travel Protection Plan - Norwegian Cruise Line

www.ncl.com4. expenses incurred for non-emergency medical evacuation, including medically appropriate transportation and medical care en route, to a Hospital or to your place of residence, when deemed medically necessary by the attending Physician, subject to the Program Medical Advisors prior approval; 5. expenses for transportation not to exceed the cost

Temporary Duty (TDY) Travel Voucher Guide

www.dfas.milThe DD Form 1351-2 is the primary form used to record travel itineraries and claim expenses for government travel. As with tax forms there is a correct way to fill out the DD 1351-2, regardless of the type of travel you are performing. The following is a step-by-step guide to ensure that you are filling the form out correctly.

Travel and Business Expense Policy (OFS-3)

www.brookings.eduAll travel and business expenses must be authorized and approved by Brookings ... • For a documented medical conditionRequests . ... record this reimbursement as …

THE COMPLETE GUIDE TO DEDUCTING BUSINESS TRAVEL …

www.hrblock.comdeductions to explore: medical expense, charitable, student loan interest, mortgage interest and more. ... A taxpayer may deduct business travel expenses IF they are ordinary and necessary and IF they are incurred away from his or her tax home. ... Create and store a …

Department of Defense

www.defensetravel.dod.milC. Request and record debt collection via payroll deduction. D. Request and record debt write-off for uncollectible debts under $225 belonging to travelers that are no longer paid by DoD in accordance with DoD FMR, Volume 4, Chapter 3.. E. Request and record debt transfers of debts $225 and over belonging to

DTS Guide 4: Local Vouchers - Defense Travel Management ...

www.defensetravel.dod.mildriven from your residence to the local travel location is 30 minus 20 for your daily commute, multiplied by the current mileage rate .56 = $5.60 reimbursement for one direction (Figure 4-7a).