Request By Fiduciary For Distribution Of

Found 7 free book(s)Unclaimed Property Law and Regulations

sco.ca.govRequest by Attorney General to Bring Action in Name of This State ..... 27 §1576. Violation ... whether that person is acting in his or her own right or in a representative or fiduciary capacity. (i) "Employee benefit plan distribution" means any money, life …

OutgOing rOllOver/transfer/exchange request fixeD/variaBle ...

professionals.voya.comUse this form to request a rollover, transfer, or exchange from your 403(b), Roth 403(b), 401, 401(k), or Pension plan to another company. Please follow the checklist to avoid delays in processing your request. A distribution is a tax reportable event that may not be reversed. RETURN COMPLETED FORMS Section 1: CONTRACT OWNER INFORMATION

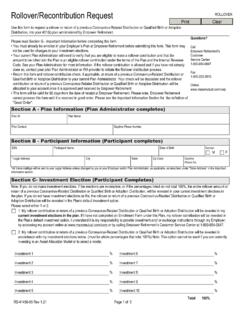

Rollover/Recontribution Request ROLLOVER

retirementsolutions.financialtrans.comRollover/Recontribution Request. Section C- Investment Election (Participant Completes) Please select either 1 or 2. 1. My rollover contribution or return of a previous Coronavirus-Related Distribution or Qualified Birth or Adoption Distribution will be invested in my . current investment elections in the plan

Instructions for Form 56 (Rev. December 2019)

www.irs.govForm 56 should be filed by a fiduciary (see Definitions below) to notify the IRS of the creation or termination of a fiduciary relationship under section 6903. For example, if you are acting as fiduciary for an individual, a decedent’s estate, or a trust, you may file Form 56. Receivers and assignees for the

For e-Filing only THE STATE OF NEW HAMPSHIRE JUDICIAL …

www.courts.nh.govDistribution (NHJB-2131-Pe) must be filed at the same time as this account. The assets must not be distributed until the court issues a distribution order and allows the final account. 8. Is an Information Schedule pursuant to Probate Rule 108(E) attached to this accounting? Yes No 9.

Bank Wire Authorization - Fidelity Investments

www.fidelity.comor the fiduciary of an employer-sponsored retirement plan, that you are responsible for complying with your legal and fiduciary obligations. • Authorize us, upon receiving instructions from you or as otherwise authorized by you, to make payments from you by credit entries to the account at the financial institution indicated in the form (Bank).

FAQs on SSA Potential Private Retirement Benefit Information

www.dol.govabandoning their individual account plans (e.g., 401(k) plans), leaving no plan fiduciary to manage it. In this situation, participants often have great difficulty in accessing the benefits they have earned and have no one to contact with questions. Custodians such as banks, insurers, and mutual fund companies are