Return For Real Estate Investment Trusts

Found 5 free book(s)2022 Instructions for Form 1 - Business Personal Property ...

dat.maryland.govo Statutory (Business Trusts), Real Estate Investment Trusts Failure to file the Annual Report may result in forfeiture of the entity’s right to conduct business in the State of Maryland. WHEN TO FILE . The deadline to file is April 15th. Should April 15th fall on a weekend, the due date is the Monday immediately following.

Personal Income Tax Guide - Estates, Trusts and Decedents ...

www.revenue.pa.govEach estate or irrevocable trust must classify and report all income and gain (loss) realized in the appropriate Pennsylvania income classes. Estates or trusts cannot offset income in one Pennsylvania income class with a loss in any other Pennsylvania income class. Estates or trusts cannot carry income or loss back or forward to other tax years.

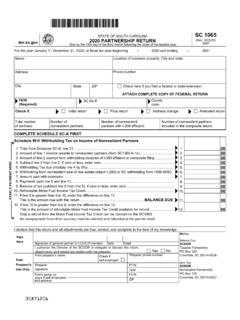

SC 1065 2020 PARTNERSHIP RETURN - South Carolina

dor.sc.govComposite Filing: A composite return is a single nonresident Individual Income Tax return filed by a partnership on behalf of two or more nonresident partners who are individuals, trusts, or estates. See the I-348, Composite Filing Instructions, at dor.sc.gov/forms for instructions.

Supplemental Income and Loss (From rental real estate ...

www.irs.govName(s) shown on return . Your social security number. Part I . Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use . Schedule C . or. C-EZ (see instructions). If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A

Supplemental Income and Loss (From rental real estate ...

www.irs.govName(s) shown on return . Your social security number. Part I . Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use . Schedule C (see instructions). If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A