Sales and use tax exemptions

Found 10 free book(s)Streamlined Sales and Use Tax Agreement Certificate of ...

www.streamlinedsalestax.orgStreamlined Sales and Use Tax Agreement Certificate of Exemption . This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to

Connecticut Sales and Use Tax for Construction Contractors

www.ctconstruction.orgCT Sales Tax . Structure of Sales Tax Law Nontaxable & Exempt sales Resales: To avoid double taxation, a sale made for resale is not subject to sales tax.

Sales and Use Tax Exemptions - Maryland Business Tax ...

btrc.maryland.govSales and Use Tax Exemptions • Tangible personal property, used in a production activity, which is not installed so that it becomes real property

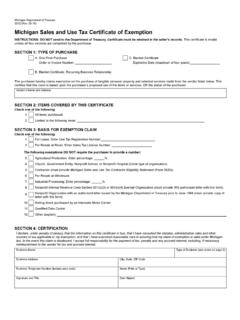

3372, Michigan Sales and Use Tax Certificate of Exemption

www.michigan.gov3372, Page 2. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Purchasers may use this form to claim exemption from Michigan sales and use tax …

State, Local and District Sales and Use Tax Return with ...

www.business-keepers.comboe-401-a2 (back) rev. 103 (4-09) state of california. board of equalization. state, local, and district sales and use tax return your account no.

AlloWABle dedUcTionS A. Sales Tax B. Use Tax

www.michigan.govThis is a return for Sales Tax, Use Tax, and/ property is transferred to the purchaser. Property transported or Withholding Tax. If the taxpayer inserts a zero on (or out of state by the purchaser does not qualify under interstate

New York State and Local Sales and Use Tax ST-121 Exempt ...

www.tax.ny.govPage 2 of 4 ST-121 (1/11) Part 2 — Services exempt from tax (exempt from all state and local sales and use taxes) Enter Certificate of Authority number here (if applicable) H. Installing, repairing, maintaining, or servicing qualifying property listed in Part 1, items A through D. Please indicate the type of qualifying property being serviced by marking an X in the applicable box(es):

2018 Sales and Use Guide Draft 2 SH 2 EAB--ab revised [Legal]

www.tn.gov'hdu 7hqqhvvhh 7d[sd\hu 7klv vdohv dqg xvh wd[ jxlgh lv lqwhqghg dv dq lqirupdo uhihuhqfh iru wd[sd\huv zkr zlvk wr jdlq d ehwwhu xqghuvwdqglqj ri 7hqqhvvhh vdohv dqg …

Sales and Use Tax Unit Exemption Certifi cate

www.tax.ohio.govSTEC U Rev. 3/15 Sales and Use Tax Unit Exemption Certifi cate The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services

This booklet has been replaced by an online guide.

www.revenue.state.mn.usThis booklet has been replaced by an online guide. DEPARTMENT OF REVENUE . Author: Kachelmeyer, Richard (MDOR) Created Date

Similar queries

Sales and use tax, Exemptions, Connecticut Sales and Use Tax, Sales Tax, Sales, Sales and Use Tax Exemptions, State, Local and District Sales and Use Tax, State, local, and district sales and use tax, Use Tax, Sales and Use Tax ST-121, ST-121, Sales and Use, Sales and Use Tax Unit Exemption Certifi cate

![2018 Sales and Use Guide Draft 2 SH 2 EAB--ab revised [Legal]](/cache/preview/c/9/8/5/6/d/6/e/thumb-c9856d6e0fb6e15dfd8aebea0113e849.jpg)