Sales tax exemption for food and beverage

Found 6 free book(s)Making the impossible possible.

www.bio.organd biomolecules for use in medicines, food and beverage processing, and industrial applications. Because of current international supply chain challenges, there is a renewed emphasis on ... Sales Tax Exemption on Equipment R&D Tax Credit For Product Development Angel Funding For Emerging Companies STATE

FYI Sales 4 Taxable and Tax Exempt Sales of Food and ...

tax.colorado.govAll state sales tax and, if applicable, state-collected local and RTD/CD, or RTA taxes must be reported and remitted with the Retail Sales Tax Return (DR 0100). Effective March 1, 2010 sales and purchases of nonessential food items and packaging provided with purchased food and beverage items are taxable at the state sales and use tax rate of 2.9%.

Alcoholic Beverages and Beer Tax Guide - Tennessee

www.tn.govWholesale Beer Tax 36 The Levy of the Tax 36 Exemption for Military Sales 36 Adjustments 36 Damaged Containers 36 Out-of-state Shipments 37 Repurchase of Previously Sold Beverages 37 Gifts or Discounts 37 Payment of the Tax 37 Delinquent Returns 38 Cash Sales 38 Wholesale Price List 38 Changes in Wholesale Price 38

Industrial Production 145 - Minnesota Department of …

www.revenue.state.mn.usBeginning July 1, 2015, the capital equipment exemption is allowed at the time of purchase. To purchase exempt, the purchaser must give the seller a completed Form ST3, Certificate of Exemption. Before July 1, 2015, you must pay sales or use tax when you buy or lease capital equipment and apply for the refund. Packaging Materials

The Record Retention Guide - CPA.NET

www.cpa.netLarge Food or Beverage Establishment Reporting Tips 3/159 Employee Tip Substantiation 3, ***/160 SECURITY SUGGESTED RETENTION PERIOD Classified Material Violations P Visitor Clearance 2 TAXATION SUGGESTED RETENTION PERIOD Tax Free Reorganization P 338 Election 7 years/150 Canceled Checks - Tax Payments P Correspondence - Tax P

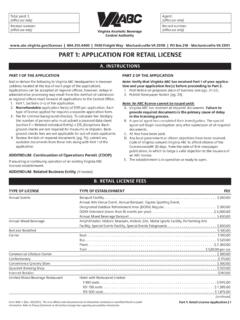

PART 1: APPLICATION FOR RETAIL LICENSE

www.abc.virginia.govBeverage Control Authority (ABC) considers all personal/tax information collected as confidential information and will not provide information to any entity except as authorized by the Code of Virginia §58.1-3 or 2.2-3700 through 2.2-3714. In the event a refund is requested, a state tax identification number will be required.