Schedule J Accumulated Earnings And

Found 4 free book(s)Sample Return - Services For CPA & Tax Preparers - All ...

www.servicesfortaxpreparers.comDepreciation not claimed on Schedule A or elsewhere on return (attach Form 4562) Depletion Advertising Pension, profit-sharing, etc., plans ... j j j j j j j j j k l l j j ... Enter the accumulated earnings and profits of the corporation at the end of the tax year. $

Documenting S Corporation Shareholder Basis - IRS tax forms

www.irs.govS Corp w/ Accumulated E&P. If the corporation has accumulated earnings and profits, AAA is relevant – Accumulated E&P can only be created while the corporation was a C corporation – Not equal to retained earnings. Determined instead based upon earnings and profits accounting methods. When a C corporation elects S status, compute earnings ...

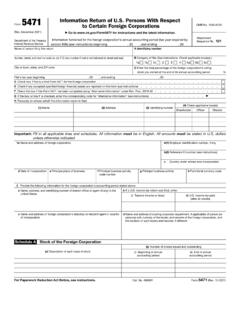

5471 Information Return of U.S. Persons With Respect

www.irs.govIf the answer to question 7 is “Yes,” complete a separate Schedule G-1 for each cost sharing arrangement in which the foreign corporation was a participant during the tax year. 8

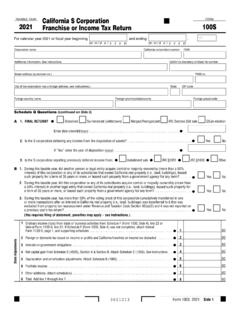

2021 Form 100S California S Corporation Franchise or ...

www.ftb.ca.gov3611213 Form 100S 2021 Side 1 B 1. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation or any of its subsidiaries that owned California real property (i.e., land, buildings), leased