Signature Titles On Irs Form

Found 7 free book(s)Beneficiary claim form – lump sum payment

eforms.metlife.comThe claim form should be completed and signed by an officer of the corporation or other institution(s). Submit it with a request for settlement on company letterhead, signed by two officers of the company with their titles. A title must be included with your signature in section 7. SECTION 1: About your claim (Required for all requests)

Form 870 Internal Revenue Service Waiver of Restrictions ...

www.irs.govCatalog Number 16894U Form 870 (Rev. 3-1992) YOUR SIGNATURE HERE SPOUSE'S SIGNATURE TAXPAYER'S REPRESENTATIVE HERE CORPORATE NAME CORPORATE OFFICER(S) ... Form 870 Internal Revenue Service (Rev. March 1992) Instructions ... titles of the corporate officers authorized to sign. An

Medical Transportation Program Provider Application

www.tmhp.comThis form is required if the applicant is incorporated. This form must be notarized, and an original signature is required. This form cannot be faxed to TMHP. The following forms must be obtained from other sources and submitted with this application as appropriate for the requested provider type: Franchise Tax Status Page

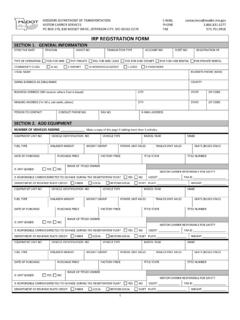

IRP REGISTRATION FORM

www.modot.orgSECTION 5. SIGNATURE The applicant or individual legally authorized to sign on behalf of the applicant must sign and date the IRP Registration Form. If a permit service signs this section, a Power of Attorney must accompany the completed form.

SAMPLE CLOSING CHECKLIST FOR ASSET PURCHASE …

betterbusinessbrokers.comD. IRS Form 8594, regarding tax allocations. VII. If the purchaser is newly formed for the transaction, the following must be finalized or considered before closing: A. Articles of incorporation/articles of organization. B. Bylaws/operating agreement. C. Record book, including incorporator and director opening minutes and

New York State Employer Registration for Unemployment ...

dol.ny.govSignature of Officer, Partner, Proprietor, Member or Individual (mm/dd/yyyy) _____ Phone no.: ( ) - Official Position Instructions Item 1 Enter your nine digit Federal Identification Number. This number is used to certify your payments to the IRS under FUTA.

Form OMB No. 1545-0056 Under Section 501(c ... - IRS tax …

www.irs.govInternal Revenue Service OMB No. 1545-0056 Note: If exempt status is be open for public inspection. Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply