Tax Information Authority Law

Found 8 free book(s)New York State and Local Sales and Use Tax ST-121 Exempt ...

www.tax.ny.govPage 2 of 4 ST-121 (1/11) Part 2 — Services exempt from tax (exempt from all state and local sales and use taxes) Enter Certificate of Authority number here (if applicable) H. Installing, repairing, maintaining, or servicing qualifying property listed in Part 1, items A through D. Please indicate the type of qualifying property being serviced by marking an X in the applicable box(es):

South Carolina Sales and Use Tax Manual 2015 Edition

dor.sc.govThe purpose of this sales and use tax manual is to provide businesses, Department of Revenue employees and tax professionals a central summary of information concerning South Carolina’s

TIP No January 11, 2019 : 19A01-01

revenuelaw.floridarevenue.comTax Information Publication TIP No: 19A01-01 Date Issued: January 11, 2019 Motor Vehicle Sales Tax Rates by State as of December 31, 2018 Motor Vehicles Sold in Florida to Residents of Another State

ASSESSMENT VALUE IN DOLLARS LEGAL CLASS RATIO …

www.pinalcountyaz.govTax Bill Explanation Annual property tax statements are provided to the public in September on a calendar year basis. (1) Parcel Number: The parcel number identifies the property / land for tax purposes.

Publications 838:(12/12):A Guide to Sales Tax for ...

www.tax.ny.govPublication 838 (12/12) About this publication As an automobile dealer (hereafter called dealer) in New York State, you have many duties and responsibilities for the collection of New York State and local sales tax, and the payment of use tax.

Gaming Tax Law and Bank Secrecy Act Issues - irs.gov

www.irs.govBank Secrecy Act (BSA), Title 31 of the Code of Federal Regulations Casinos are cash intensive businesses, which can offer a broad array of financial services, such as deposit

CORPORATION TAX BULLETIN 2018-03 Issued: July 6, 2018

www.revenue.pa.govCORPORATION TAX BULLETIN 2018-03 Issued: July 6, 2018 This bulletin supersedes Corporation Tax Bulletin 2017-02 Bonus Depreciation Before Act 72 of 2018

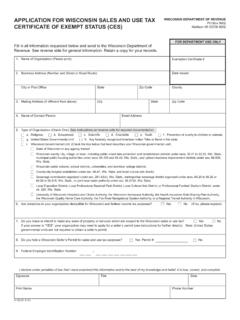

September 2010 S-103 Application for Wisconsin Sales and ...

www.revenue.wi.govapplication for wisconsin sales and use tax. certificate of exempt status (ces) wisconsin department of revenue. po box 8902 madison wi 53708-8902. for department use only