Search results with tag "Premium tax credit"

2016 Publication 17 - IRS tax forms

www.irs.govHealth coverage tax credit (HCTC). The HCTC is a tax credit that pays a percentage of health in-surance premiums for certain eligi-ble taxpayers and their qualifying family members. The HCTC is a separate tax credit with different el-igibility rules than the premium tax credit. You may have received monthly advance payments of the

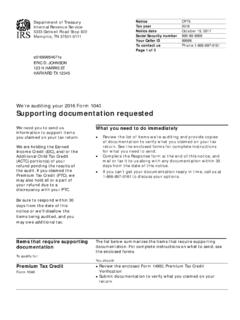

You need to send supporting documentation - IRS tax forms

www.irs.govCredit. Premium Tax Credit Form 1040 • Review the enclosed Form 14950, Premium Tax Credit Verification. • Submit the documentation requested to show you’re entitled to claim the Premium Tax Credit. Department of the Treasury Internal Revenue Service Examination Operations Stop 22B PO Box 47-421 -0421 CP75 Tax year 2016

published, go to IRS.gov/Pub974 For the ... - IRS tax forms

www.irs.govpremium tax credit. If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through the Marketplace for 2020 and advance payments of the premium tax credit (APTC) were made for this coverage, you must file a 2020 return and attach Form 8962 to claim a net PTC. You (or whoever enrolled

You must file a return if any of the ... - IRS tax forms

apps.irs.gov5. Advance payments of the premium tax credit were made for you, your spouse, or a dependent who enrolled in coverage through the Marketplace. You or whoever enrolled you should have received Form(s) 1095-A showing the amount of the advance payments. 6. Advance payments of the health coverage tax credit were made for you, your spouse, or a ...

2021 Form 8962 - IRS tax forms

www.irs.govTotal premium tax credit. Enter the amount from line 11(e) or add lines 12(e) through 23(e) and enter the total here