Example: dental hygienist

Search results with tag "Federal unemployment tax act"

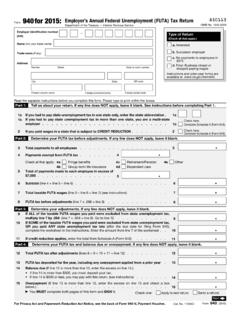

Form for 2015: Employer's Annual Federal Unemployment ...

www.irs.gov23, Federal Unemployment Tax Act, of Subtitle C, Employment Taxes, of the Internal Revenue Code imposes a tax on employers with respect to employees. This form is used to determine the amount of the tax that you owe. Section 6011 requires you to provide the requested information if you are liable for FUTA tax under section 3301.

Reporting Sick Pay Paid by Third Parties - IRS tax forms

www.irs.govFederal Unemployment Tax Act (FUTA) tax (collectively, “employment taxes”), or other taxes. This notice also sets forth the rules concerning responsibility for the withholding and payment of employment taxes and for reporting employment taxes and wages with