Search results with tag "Wisconsin department of revenue"

February 2021 S-211 Wisconsin Sales and Use Tax Exemption ...

www.revenue.wi.govWisconsin Sales and Use Tax Exemption Certificate. Do not send this certificate to the Department of Revenue. Form. S-211. S-211 (R. 2-21) This Form May Be Reproduced. Wisconsin Department of Revenue Farming. Tractors (except lawn and garden tractors), all-terrain vehicles (ATV) and farm machines, including accessories, attachments, and

Sales Tax Exemptions for Nonprofit Organizations

www.revenue.wi.gov410, and 403 are available on the depart ment’s website. CAUTION The information in this publication reflects the position of the Wisconsin Department of Revenue of laws enacted by the Wisconsin Legislature as of 1, 201Ma6y. Laws enac ted and in …

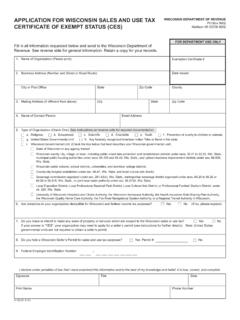

February 2021 S-103 Application For Wisconsin Sales and ...

www.revenue.wi.govApplication for Wisconsin Sales and Use Tax. Certificate of Exempt Status (CES) Wisconsin Department of Revenue. PO Box 8902. Madison WI 53708-8902. S-103 (R. 02-21) Signature. I declare under penalties of law that I have examined this information and to the best of my knowledge and belief, it is true, correct, and complete. Title. Date. Print ...

School Districts by Tax District - Wisconsin Department of ...

www.revenue.wi.govwisconsin department of revenue ... 03 008 2903 1260 111 barron bear lake 17 sch d of cumberland 03312 79 79 03 008 2903 4802 111 barron bear lake 17 sch d of rice lake area 03365 79 79 03 008 4000 1700 000 barron bear lake northwood technical college 76517 79 79 ...

Pub 202 Sales and Use Tax Information for Motor Vehicle ...

www.revenue.wi.govThe information in this publication reflects the positions of the Wisconsin Department of Revenue of laws enact-ed by the Wisconsin Legislature and in effect Mayas of 1, 2017. Laws enacted and in effect after this date, administrative rules, and court decisions may change the interpretations in this publication. Also note that lists of

Hotels, Motels, and Other Lodging Providers

www.revenue.wi.govHotels, Motels, and Other Lodging Providers Publication 219 . 3 Back to Table of Contents. CAUTION The information in this publication reflects the positions of the Wisconsin Department of Revenue of laws enacted by the Wisconsin Legislature and in effect as of 1, 2018. Laws enacted and in effect after this date, new November

STATE OF SOUTH CAROLI NA DEPARTMENT OF REVENUE

dor.sc.govWisconsin Department of Revenue v. William Wrigley, Jr., Co., 505 U.S. 214 (1992), SC Revenue Ruling #97-15, SC Private . Letter Ruling #94-8, and SC Code Section 12-6-4920. 10. Does South Carolina conform to the Multistate Tax Commission’s Nexus .

Request a Payment Plan - Wisconsin Department of Revenue

www.revenue.wi.gov•We will charge you a collection fee on DOR tax debt equal to 6.5% of your amount due, with a minimum charge of $35. The collection fee for state debt referred by another agency is 15% of the amount due, with a minimum charge of $35. Part C: Your Spouse Iamnotmarried.SkiptoPartD. General Assistance Wisconsin Works Payments Social Security / SSI

Extensions of Time to File - Wisconsin Department of Revenue

www.revenue.wi.govwith the Wisconsin Department of Revenue, as well as addresses and telephone numbers to use for obtaining additional information about extensions. ... physical presence test to qualify for the foreign earned income exclusion and/or the foreign housing exclusion or deduction (use federal Form 2350).

2017 I-128 Instructions for Completing Wisconsin …

www.datpub.comI-128 (R. 12-17) Wisconsin Department of Revenue General Instructions Introduction – Generally, the Wisconsin Statutes require that the computation of taxable income on the 2017 Wisconsin

September 2010 S-103 Application for Wisconsin Sales and ...

www.revenue.wi.govapplication for wisconsin sales and use tax. certificate of exempt status (ces) wisconsin department of revenue. po box 8902 madison wi 53708-8902. for department use only

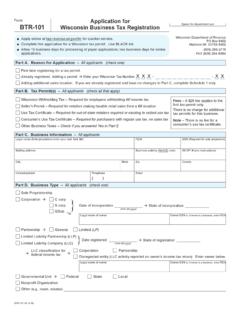

October 2021 BTR-101 Application for Wisconsin Business ...

www.revenue.wi.govWisconsin Department of Revenue PO Box 8902. Madison WI 53708-8902 (608) 266-2776 FAX (608) 327-0232 BTR-101. Form. Application for. Wisconsin Business Tax Registration Apply online at tap.revenue.wi.gov/btr. for quicker service. Complete this application for a Wisconsin tax permit. Use BLACK ink.

Sales and Use Tax Information for Contractors

www.revenue.wi.govThe information in this publication reflects the positions of the Wisconsin Department of Revenue of laws enacted by the Wisconsin Legislature and in effect as of 1, 201. Laws enacted and in effect after this date, new 9 January ... and digital codes. These digital goods are characterized by the fact that they are transferred electronically to ...

2015 I-128 Instructions for Completing Wisconsin Schedule I

www.revenue.wi.govInstructions for Completing Wisconsin Schedule I – 2015. Schedule I Instructions I-128 (R. 1-16) Wisconsin Department of Revenue 2 ITEMS REQUIRING ADJUSTMENT Following are brief explanations of differences between federal and Wisconsin law. The “Federal” explanation indicates how an item is to be treated

June 2020 W-204 WT-4 Employee's Wisconsin Withholding ...

www.revenue.wi.govEmployee’s Wisconsin Withholding Exemption Certificate/New Hire Reporting. WT-4. W‑204 (R. 6‑20) Wisconsin Department of Revenue. EMPLOYEE INSTRUCTIONS: • WHO MUST COMPLETE: Effective on or after January 1, 2020, every newly‑hired employee is required to provide a completed Form WT‑4 to each of his or her employ‑ ers.

AT-103 Auxiliary Questionnaire Alcohol Beverage License ...

www.revenue.wi.govAuxiliary Questionnaire Alcohol Beverage License Application AT-103 (R. 7-18) Wisconsin Department of Revenue Submit to municipal clerk. (Signature of Named Individual) Home Phone Number Age Date of Birth Place of Birth Home Address (street/route) Post …

Sales and Use Tax Information for Contractors

www.revenue.wi.govSales and Use Tax Information for Contractors Publication 207 Back to Table of Contents 3 . CAUTION The information in this publication reflects the positions of the Wisconsin Department of Revenue of laws enacted by

Pub 240 Digital Goods - Wisconsin Department of Revenue

www.revenue.wi.govPublication 240 (11/21) TABLE OF CONTENTS ... Form BTR-101, or on the application on the Streamlined Sales Tax Governing Board's website. Digital Goods Publication 240 : 6 ... department by mail or email at DORBusinessTax@wisconsin.gov or by telephone at …

December 2021 W-204 WT-4 Employee's Wisconsin …

www.revenue.wi.govEmployee’s Wisconsin Withholding Exemption Certificate/New Hire Reporting. WT-4. W‑204 (R. 12‑21) Wisconsin Department of Revenue. EMPLOYEE INSTRUCTIONS: • WHO MUST COMPLETE: Effective on or after January 1, 2020, every newly‑hired employee is required to provide a completed Form WT‑4 to each of their employers.

December 2017 S-211-SST Wisconsin Streamlined Sales and ...

www.revenue.wi.govWisconsin Streamlined Sales and Use Tax Agreement Exemption Certificate S-211-SST (R. 12-17) Wisconsin Department of Revenue This is a multi-state form. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this ...

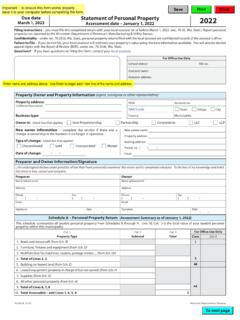

2022 PA-003 Statement of Personal Property

www.revenue.wi.govStatement of Personal Property Assessment date – January 1, 2022 Due date March 1, 2022 2022 Filing Instructions – you must file this completed return with your local assessor on or before March 1, 2022. (sec. 70.35, Wis. Stats.) Report personal property not reported to the Wisconsin Department of Revenue’s Manufacturing & Utility Bureau.

Operators' Licenses - Wisconsin Department of Revenue

www.revenue.wi.govAug 20, 2018 · However, an operator's license from any municipality may be used on a permitted vessel (boat). An operator's license may be issued for one or two years, as determined by the governing body of the issuing municipality. Operator's licenses in first class cities (City of Milwaukee) expire on December 31 and on June 30 for all other municipalities.

Multi-Parcel Tax Exemption Report For THIS FORM MUST …

www.revenue.wi.govTHIS FORM MUST BE FILED WITH THE MUNICIPAL CLERK NO LATER THAN MARCH 31, in even numbered years (sec. 70.337, Wis. Stats.) (See instructions on reverse side) Multi-Parcel Tax Exemption Report For (Enter Year) 1. Name of Organization 2. Purpose of Organization PC-220A (R. 9-16) Wisconsin Department of Revenue 6. Parcel Number or Legal ...

April 2020 S-012 ST-12 Wisconsin Sales and Use Tax Return ...

www.revenue.wi.govWisconsin Sales and Use Tax Return Form ST-12 Wisconsin Department of Revenue State, County and Stadium Sales and Use Tax Use BLACK INK Only Check if this is an amended return Check if address or name change (note changes at left) Check if correspondence is included Sales Subject to Stadium Sales Tax Step C Sales Tax Before Discount

Restaurants and Bars - Wisconsin Department of Revenue

www.revenue.wi.govCandy is taxable. "Candy" includes any preparation of sugar, honey, or other natural or artificial sweetener combined with chocolate, fruit, , or other ingredients or flavorings in the form of bars, drops, onuts r pieces, but does not include any product that …

March 2019 AT-106 Original Alcohol Beverage Retail License ...

www.revenue.wi.govOriginal Alcohol Beverage Retail License Application (Submit to municipal clerk.) AT-106 (R. 3-19) Wisconsin Department of Revenue. Applicant’s Wisconsin Seller’s Permit Number

November 2014 S-211 Wisconsin Sales and Use Tax Exemption ...

www.revenue.wi.govS R 1-14) Wisconsin Department of Revenue Governmental Units and Other Exempt Entities The United States and its unincorporated agencies and instrumentalities.

2021 Agricultural Assessment Guide for Wisconsin Property ...

www.revenue.wi.govC. Farmland Advisory Council The Farmland Advisory Council oversees agriculture use-value . The Wisconsin Department of Revenue (DOR) Secretary chairs the ten member council . These members represent agricultural, financial, academic, assessment, environmental and governmental interests . State law (sec .73 .03(49), Wis .

2021 Property Assessment Process Guide for Municipal Officials

www.revenue.wi.govThe Wisconsin Department of Revenue (DOR) is responsible for tax law administration while the local taxation jurisdiction is responsible for valuation and tax collection . This document provides information on how to contract for assessors’ services . This publication provides general information, not legal advice .

Withholding Tax Guide - Wisconsin Department of Revenue

www.revenue.wi.govJan 01, 2022 · b enefits 12 m. h ealth s avings a ccounts 12 n. t hird p arty s ick p ay 12 o. p ensions 13 p. r eporting of w ages for a gricultural, d omestic, or o ther e mployees e xempt from w ithholding 13 q. w illful m isclassification p enalty for c onstruction c ontractors 13 r. p ayments m ade to d ecedent e state or b eneficiary 13 4.

2022 Assessment and Tax Roll Instructions for Clerks

www.revenue.wi.gov(Form PA-521C) . A municipal clerk must file a copy of the SOA with the Wisconsin Department of Revenue (DOR) by the due date for two reasons: a . If a taxation district contains manufacturing property, DOR must review and approve the locally assessed values before adding its manufacturing property values and producing the final equated SOA and

Pub 203 Sales and Use Tax Information for Manufacturers ...

www.revenue.wi.govState of Wisconsin Department of Revenue. Sales and Use Tax . Information for . Manufacturers . Publication 203 (06/16) Important Changes • Calumet County tax begins April 1, 2018

Instructions Compiling Financial Report Forms C and CT for ...

www.revenue.wi.govYou must electronically file (e-file) the Financial Report Form (MFR) with the Wisconsin Department of Revenue (DOR) . The due date is provided under state law (sec . 86 .303(5), Wis . Stats .), which requires municipalities with a population of 2,500 or less to file a properly completed financial report by March 31 . Municipalities over 2,500

Title/License Plate Application How To Complete This ...

wisconsindot.govFor all tax questions, call the Wisconsin Department of Revenue at (608) 266-2776. License Plate Fee Regular passenger vehicle plates are for automobiles, vans with more space for seating people than carrying property, and jeep-type or sport utility vehicles with a back seat.

Composite Useful Lives - Wisconsin Department of Revenue

www.revenue.wi.govComposite Useful Lives Recommended for Use on Equipment Used by Retailers, wholesalers, and Service Organization ... 54185 7312 Outdoor Advertising Structures 10 33422 3663 Pagers – One-Way 6 23731, 23832, 711510 1721 Painter 10 42495, 44412 5198, 5231 Paints & Varnishes 10 322211 2653 ...

Property Tax Overview - Wisconsin Department of Revenue

www.revenue.wi.govDec 27, 2019 · Property Tax Overview . Introduction . The property tax is the primary tax for local governments –school districts, technical college districts, counties, municipalities (towns, villages, and cities), and special districts (town sanitary districts, metropolitan sewerage distric ts, and inland lake districts). Gross property taxes levied

Wisconsin Department of Workforce Development (DWD) …

dwd.wisconsin.govService (IRS) and Wisconsin Department of Revenue, we also share information about your claim with other federal and state agencies to help them determine your eligibility or amounts of benefits payable under their programs. Some of those programs include General Assistance, Food Stamps, Wisconsin Works (W-2), Temporary Assistance for Needy ...

Wisconsin Tax Bulletin - Wisconsin Department of Revenue

www.revenue.wi.govThe Wisconsin Legislature has enacted a number of changes to the Wisconsin tax laws. Following is an index and brief descriptions of the major individual and fiduciary income tax, corporation franchise and

Wisconsin Guide for Property Owners

www.revenue.wi.govproperty valuation, see the Wisconsin Property Assessment Manual . Contact your local assessor for information about your property assessment and your local clerk for information about your property taxes . Information in this publication was prepared by the Wisconsin Department of Revenue’s Office of Technical and Assessment Services . II.

Wisconsin Electronic Real Estate Transfer Return (RETR ...

www.revenue.wi.govBack to Table of Contents Wisconsin Department of Revenue (r. 1/18) Page 1 Wisconsin Electronic Real Estate Transfer Return (RETR) Instructions. Table . of Contents. Getting started 1. Grantors 2. Grantees 3. Parcels 4. Legal description 5. Physical description 6. Transfer . 7. Financing 8. Weatherization 9. Fee computation 10. Chapter 77.25 ...

Wisconsin Municipal Assessors March 2019

www.revenue.wi.govWisconsin Municipal Assessors March 2019 Wisconsin Department of Revenue Division of State & Local Finance P.O. Box 8971 Madison, WI 53708-8971 Assessor List (R. 03-19)

Wisconsin Municipal Assessors November 2021

www.revenue.wi.govWisconsin Department of Revenue Division of State & Local Finance P.O. Box 8971 Madison, WI 53708-8971 Assessor List (R. 11-21) ABBOTSFORD ABBOTSFORD ABRAMS ACKLEY ADAMS ADAMS ADAMS ADAMS ADDISON ADELL ... 149 TOWER RD 10266N RIDGEROCK CT PO BOX 342 PO BOX 415 PO BOX 415 11055 W ARROW RD PO BOX 131 Address …

Wisconsin Tax Bulletin - Wisconsin Department of Revenue

www.revenue.wi.govNew Tax Laws A. Individual and Fiduciary Income Taxes 1. Internal Revenue Code References Updated for 2021 for Individuals, Estates, and Trusts (2021 Wis. Act 1, repeal sec. 71.01(6)(c), (d), (e), (f), (g), (h), and (i), amend sec. 71.01(6)(L)1., and create sec. 71.01(6)(m), effective for taxable years beginning after December 31, 2020)

Similar queries

Wisconsin, Exemption Certificate, Wisconsin Department of Revenue, Depart ment, Wisconsin Sales, Wisconsin Sales and Use Tax. Certificate of Exempt Status, Bear, 2017, And Other, DEPARTMENT OF REVENUE, Revenue, Collection, Debt, Housing, 2017 Wisconsin, September 2010 S-103 Application for Wisconsin, Wisconsin Business Tax Registration, Wisconsin tax, Codes, Instructions for Completing Wisconsin, Instructions, Employee, Wisconsin Withholding, Wisconsin Withholding Exemption Certificate, Auxiliary Questionnaire Alcohol Beverage, Use Tax Information for Contractors, Publication, Streamlined, Mail, S Wisconsin, S Wisconsin Withholding, Sales, Wisconsin Streamlined Sales and Use Tax Agreement Exemption Certificate, Statement of Personal Property, Operator, Multi-Parcel Tax Exemption Report, MUST, MUST BE FILED, Wisconsin Sales and Use Tax, Sales and Use Tax, Sugar, Ingredients, Original Alcohol Beverage, License Application, 211 Wisconsin, Advisory, Members, Taxation, B enefits, Municipal, Sales and Use Tax Information for Manufacturers, Sales and Use Tax . Information for . Manufacturers, Financial, Form, License Plate Application, Composite Useful Lives, Structures, Property Tax Overview, Wisconsin Department of Workforce Development, Wisconsin Tax Bulletin, Tax laws, Property, Real Estate, Wisconsin Municipal Assessors, TOWER, Income, Amend