Search results with tag "Department of the treasury internal revenue service"

19 Internal Revenue Service Department of the Treasury

www.irs.govDepartment of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit (PTC) and reconcile it with advance payment of …

W-9 Request for Taxpayer - Internal Revenue Service

www.irs.govDepartment of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification. ... Section references are to the Internal Revenue Code unless otherwise noted. ... the rules under section 1446 require a partnership to presume that a …

TITLE 26 -- INTERNAL REVENUE SERVICE REGULATIONS

www.exeter1031.comtitle 26 -- internal revenue service regulations chapter i -- internal revenue service department of the treasury subchapter a -- income tax

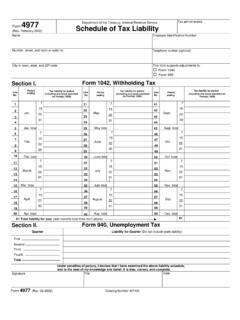

4977 Department of the Treasury- Internal …

www.irs.govDepartment of the Treasury- Internal Revenue Service Tax period ended Form 4977 Schedule of Tax Liability (Rev. February 2002)Section I. Form 1042, Withholding Tax Period Tax liability for period Tax liability for period

[4830-01-p] DEPARTMENT OF THE TREASURY …

www.irs.gov[4830-01-p] DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Parts 1, 54 and 301 [REG-138006-12] RIN 1545-BL33 Shared Responsibility for Employers Regarding Health Coverage

SCHEDULE O Transfer of Property to a Foreign …

www.irs.govSCHEDULE O (Form 8865) 2017 Transfer of Property to a Foreign Partnership (under section 6038B) Department of the Treasury Internal Revenue Service

Internal Revenue Service Department of the Treasury

www.novoco.comFeb 14, 2022 · Internal Revenue Service Department of the Treasury Washington, DC 20224 Number: 202206016 Release Date: 2/11/2022 ... manner as may be prescribed by the Commissioner of Internal Revenue in the Internal Revenue Service forms or instructions, or in publications or guidance published in the Internal Revenue Bulletin.

DEPARTMENT OF THE TREASURY Internal Revenue Service

www.treasury.govDEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [REG-142695-05] RIN 1545-BF00 Employee Benefits - Cafeteria Plans AGENCY: Internal Revenue Service (IRS), Treasury. ACTION: Withdrawal of prior notices of proposed rulemaking, notice of proposed rulemaking and notice of public hearing.

DEPARTMENT OF THE TREASURY - Internal Revenue Service

www.irs.gov1 [4830-01-u] DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [TD 8878 ] RIN 1545-AU61 Tax Treatment of Cafeteria Plans AGENCY: Internal Revenue Service (IRS), Treasury.

DEPARTMENT OF THE TREASURY Internal Revenue Service

public-inspection.federalregister.govDEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [REG-118250-20] RIN 1545-BP94 Guidance on Passive Foreign Investment Companies and Controlled Foreign Corporations Held by Domestic Partnerships and S Corporations and Related Person Insurance Income AGENCY: Internal Revenue Service (IRS), Treasury.

DEPARTMENT OF THE TREASURY Internal Revenue …

www.treasury.govDEPARTMENT OF THE TREASURY Internal Revenue Service ... Internal Revenue Service (IRS), ... Internal Revenue Code (Code). Section 864(e) ...

DEPARTMENT OF THE TREASURY

www.irs.gov1 [4830-01-u] DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [TD 8921] RIN 1545-AY23 Tax Treatment of Cafeteria Plans AGENCY: Internal Revenue Service (IRS), Treasury.

Internal Revenue Service Department of the Treasury

www.irs.govPLR-102728-02 2 1 The national office generally issues a letter ruling on a proposed transaction and on a completed transaction if the letter ruling request is submitted before the return is filed for the year in which the transaction that is the subject of the request was

Internal Revenue Service Department of the Treasury

www.irs.govInternal Revenue Service Number: 200130015 Release Date: 7/27/2001 Index Number: 451.14-00 Department of the Treasury Washington, DC 20224 Person to Contact:

Department of the Treasury Internal Revenue Service

www.treasury.govDepartment of the Treasury . Internal Revenue Service . Congressional Justification . for Appropriations and . Annual Performance . Report and Plan . FY 2018

Department of the Treasury INTERNAL REVENUE SERVICE

www.irs.govBy filing the Notice of Federal Tax Lien, other creditors are put on notice that the United States government has a claim against all property, and any rights to property, of the taxpayer.

The Honorable Janet Yellen The Honorable Charles P. Rettig ...

www.feinstein.senate.govJan 26, 2022 · U.S. Department of the Treasury Internal Revenue Service 1500 Pennsylvania Avenue, NW 1111 Constitution Avenue, NW Washington, D.C. 20220 Washington, D.C. 20224 Dear Secretary Yellen and Commissioner Rettig: In light of the December 2021 Government Accountability Office (GAO)

Department of the Treasury - GPO

www.gpo.govVol. 79 Wednesday, No. 29 February 12, 2014 Part II Department of the Treasury Internal Revenue Service 26 CFR Parts 1, 54, and 301 Shared Responsibility for Employers Regarding Health Coverage; Final

Internal Revenue Service Department of the Treasury …

www.irs.govDec 12, 2014 · PLR-106528-14 2 Taxpayer is the common parent of a group of affiliated corporations that files a consolidated federal income tax return on a calendar year basis.

Department of the Treasury - Internal Revenue Service …

www.irs.govCatalog Number 66138J. www.irs.gov Form . 14568 (Rev. 9-2017) For Paperwork Reduction Act information see the current EPCRS Revenue Procedure. Form

Internal Revenue Service Department of the Treasury

www.irs.gov2 PLR 119417-99 12, 2000, and July 10, 2000, are set forth below. Taxpayer requests four rulings. First, Taxpayer requests a ruling that the transaction described below qualifies as a …

Internal Revenue Service Department of the Treasury

www.irs.gov2 workers covered by collective bargaining agreements (Agreement) between Union and Association. Trust was previously granted tax-exempt status under section 501(c)(9) of

Internal Revenue Service Department of the Treasury

www.irs.gov3 annuities." Section 72(s) in general provides that a contract will not be treated as an annuity contract for federal income tax purposes unless, with certain exceptions, it provides for

Similar queries

Internal Revenue Service Department of the Treasury, Department of the Treasury Internal Revenue Service Section references, Internal Revenue, Request for Taxpayer, Internal Revenue Service, Department of the Treasury Internal Revenue Service, Section references, Section, Internal revenue service regulations, Department of the Treasury- Internal, Department of the Treasury- Internal Revenue Service, Department of the Treasury, Property to a Foreign, Property to a Foreign Partnership, Internal Revenue Service Department of the Treasury Washington, Treasury, DEPARTMENT OF THE TREASURY Internal Revenue, Internal Revenue Code, Code, Treatment, Department of the Treasury Washington, Department of the Treasury . Internal Revenue Service, Justification, Washington, Department of the Treasury - Internal Revenue Service, Revenue

![[4830-01-p] DEPARTMENT OF THE TREASURY …](/cache/preview/6/5/b/9/7/a/d/5/thumb-65b97ad51eb0fa6035789892393b945e.jpg)