Search results with tag "Minnesota department of revenue"

2020 M4NP Series - Minnesota Department of Revenue

www.revenue.state.mn.usMail to: Minnesota Department of Revenue, Mail Station 1257, 600 N. Robert St., St. Paul, MN 55146-1257. I authorize the Minnesota Department of Revenue . to discuss this tax return with the paid preparer listed here. Name of Organization FEIN Minnesota Tax ID *204021* Authorized Signature Title Date (MM/DD/YYYY) Daytime Phone

2021 Minnesota Income Tax - Minnesota Department of …

www.revenue.state.mn.usIRS Letter 2800C tells you when the IRS believes your employee may have filed an incorrect federal Form W-4. If you receive this letter, you . must provide the Minnesota Department of Revenue with a copy of the employee’s Form W-4MN. We will verify the number of allowances your employee may claim for Minnesota purposes.

2020 Minnesota Income Tax - Minnesota Department of …

www.revenue.state.mn.us12 Surety Deposits for Non-Minnesota Construction Contractors 13 Construction Contracts with State and Local Government Agencies 19 Nonresident Wage Income Assigned to Minnesota 20 Reciprocity. The information you provide on your tax return is private by state law. The Minnesota Department of Revenue cannot provide it to others without your

Use Tax for Businesses - Minnesota Department of Revenue

www.revenue.state.mn.usInterstate motor carriers authorized to pay use tax directly to the Minnesota Department of Revenue must pay use tax on a percentage of the cost of parts and accessories and leased equipment. For more information, see the Transportation Service Providers Industry Guide.

Capital Equipment 103 - Minnesota Department of Revenue

www.revenue.state.mn.us2 Minnesota Revenue, Capital Equipment Capital equipment does not include: • farm machinery, aquaculture and logging equipment • motor vehicles taxed under Minnesota Statutes, section 297B (vehicles for road use) motor vehicle washing, waxing and cleaning services • building materials that become part of a general building structure or that are an addition, repair, improvement or

Powerof Attorney - Minnesota Department of Revenue

www.revenue.state.mn.usPowerof Attorney Readthe instructionson the back before completingthis form. REV184 Taxpayer’s name (person or business) Social Security or Minnesota tax ID number (or federal ID number)

Special Local Taxes 164S - Minnesota Department of Revenue

www.revenue.state.mn.usMinnesota Revenue – Special Local Taxes 3 Beginning July 1, 2013, the city of Marshall will have a 1.5 percent Food and Beverage tax. This tax is in addi-tion to …

2017 M1, Individual Income Tax Return

www.revenue.state.mn.usMail to: Minnesota Individual Income Tax St. Paul, MN 55145-0010 To check on the status of your refund, visit www.revenue.state.mn.us I authorize the Minnesota Department of Revenue to discuss this return with my paid preparer or the ... 2017 M1, Individual Income Tax Return

Delivery Charges 155 - Minnesota Department of Revenue

www.revenue.state.mn.us2 Minnesota Revenue, Delivery Charges by the customer the cost of the materials is not billed directly to the recipients For more information, see Fact Sheet 173, Direct Mail and Fulfillment Services.

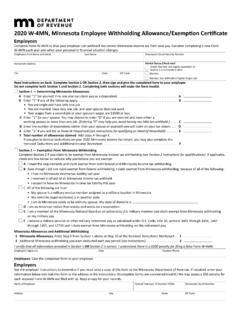

W-4MN, Minnesota Employee Withholding …

www.revenue.state.mn.us2020 W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate Employees: Give the completed form to your employer. Employers See the employer instructions to determine if you must send a copy of this form to the Minnesota Department of Revenue. If required, enter your information below and mail this form to the address in the ...

2020 M3 Instructions - Minnesota Department of Revenue

www.revenue.state.mn.us• Calendar year returns: March 15, 2021. • Fiscal year returns: the 15th day of the third month after the end of the tax year. If the due date lands on a weekend or legal holiday, returns and payments electronically made or postmarked the next business day are considered timely. Extension of Time to File

Local Sales and Use Taxes - Minnesota Department of Revenue

www.revenue.state.mn.us2 Minnesota Revenue, Local Sales and Use Taxes You ship taxable items into a local area. How to figure the tax rate To figure the tax rate, add the state and local sales tax rates.

2018 Minnesota Income Tax - Minnesota Department of Revenue

www.revenue.state.mn.usInstruction Booklet and Tax Tables Start using this booklet Jan. 1, 2018 Minnesota Income Tax Withholding 2018 Need help with your taxes? We’re ready to answer your questions!

ST11, Sales and Use Tax Refund Request

www.revenue.state.mn.usMain business address in Minnesota (if different from above) City State ZIP code Name of person to contact about this request Title Phone Email ST11. Sales and Use Tax Refund Request . Send Form ST11, your worksheet(s), and supporting documents: Mail: Minnesota Department of Revenue . Mail Station 6330 600 N. Robert Street St. Paul, MN 55146-6330

Labor - Minnesota Department of Revenue

www.revenue.state.mn.usMinnesota Revenue, Labor 2 Fabrication labor Fabrication labor makes or creates a product or alters an existing product into a new or changed product.

Industrial Production 145 - Minnesota Department of Revenue

www.revenue.state.mn.us3 Minnesota Revenue, Industrial Production Materials purchased to make your own special tooling are taxable, because materials are not special tools as described

Contractors 128 - Minnesota Department of Revenue

www.revenue.state.mn.usMinnesota Revenue – Contractors 2 Is the improvement or fixture real property? Building materials and supplies Building materials and supplies are tangible personal property when purchased.

Delivery Charges 155 - Minnesota Department of Revenue

www.revenue.state.mn.usitems purchased with a completed Form ST3, Certificate of Exemption items shipped to customers outside Minnesota Capital Equipment Capital equipment may have delivery charges. If an item qualifies for the capital equipment exemption, the delivery charges also qualify for exemption. What’s New We made general updates to this fact sheet.

105 9-17 logo - Minnesota Department of Revenue

www.revenue.state.mn.ushard hats and liners helmets (all types) paint or dust respirators reflective or safety vests, aprons, gloves, suits, etc. safety belts safety glasses and goggles (nonprescription) tool belts welding gloves and masks Fur clothing Clothing made of fur is taxable. Fur clothing means human wearing apparel that is required to be labeled as a fur

Preliminary Estimates - Minnesota Department of Revenue

www.revenue.state.mn.usPreliminary Estimates Revised February 16, 2018 Federal Update: The Tax Cuts and Jobs Act of 2017 As Enacted FY 2018 FY 2019 FY 2020 FY 2021

2016 M4, Corporation Franchise Tax Return

www.revenue.state.mn.us9995 I authorize the Minnesota Department of Revenue to discuss this tax return with the preparer . I declare that this return is correct and complete to the best of my knowledge and belief.

2016 Mining Tax Guide - Minnesota Department of Revenue

www.revenue.state.mn.us2016 Mining Tax Guide. Total Production Tax — $1 06,987,271 * Production Tax per taxable ton – $2. ... The Production Tax distributed in 2016 is the tax due for the 2015 production year. ... content exceeds 72 percent. The taxable tonnage for 2015 is the average tonnage produced in 2013, 2014 and 2015. If this tax is imposed on other iron ...

Solid Waste Management Tax Exemption Certificate

www.revenue.state.mn.usSolid Waste Management Tax Exemption Certificate SWMT-10 Check the reason for the exemption ollect and pay the Solid Waste Management (SWM) Tax to the Minnesota Department of Revenue on charges to my I c

Clothing - Minnesota Department of Revenue

www.revenue.state.mn.us• Altering clothing (shortening or lengthening, fitting, restyling lapels or ties, etc.) • Dyeing clothing • Embroidery or screen printing done on clothing provided by the customer • Fur (natural and synthetic) cleaning, repairing, and storing • Hat blocking • Laundry, dry cleaning, and pressing services

ABR, Application for Business Registration

www.revenue.state.mn.us2 n call 651-282-5225 or 1-800-657-3605 n fax your completed pages to 651-556-5155 (Do not fax blank pages.) n mail your completed pages to: Minnesota Department of Revenue Mail Station 4410

Minnesota Application for Business Registration

www.revenue.state.mn.usRegistration Instruction Booklet How to register Online: www.revenue.state.mn.us Phone: 651-282-5225 or 1-800-657-3605 8:00 a.m. – 4:00 p.m. Monday through Friday Fax:651-556-5155 Mail: Minnesota Department of Revenue Business Registration Mail Station 4410 600 N. Robert St. St. Paul, MN 55146-4410

Minnesota income tax brackets for 2016

www.revenue.state.mn.usFOR IMMEDIATE RELEASE November 5, 2015 Contact: Ryan Brown Ryan.brown@state.mn.us Minnesota income tax brackets for 2016 ST. PAUL, Minn. – The Minnesota Department of Revenue announced the adjusted 2016

Similar queries

Minnesota Department of Revenue, Minnesota, 2021 Minnesota Income Tax, Minnesota Department of, Employee, 2020 Minnesota Income Tax, Capital Equipment, Capital Equipment Capital equipment, Powerof Attorney, REV184, Special Local Taxes, 2017, Individual Income Tax, Delivery Charges 155, Delivery Charges, Withholding, Certificate, Instructions, Year, Fiscal year, Holiday, Local Sales and Use Taxes, State, 2018 Minnesota Income Tax, Labor, Industrial Production, Improvement, Form ST3, Hats, Preliminary Estimates, 2016 Mining Tax Guide, 2016, 2015, SWMT-10, Clothing, Laundry, Application for Business Registration, Registration, Booklet, Minnesota income tax brackets for