Search results with tag "Employee stock ownership plans"

FAQs about Retirement Plans and ERISA - DOL

www.dol.govcontribute to the plan (out of profits or otherwise) in cash or employer stock. The plan contains a formula for allocating the annual contribution among the participants. What are employee stock ownership plans (ESOPs)? Employee Stock Ownership Plan (ESOP) – A type of defined contribution plan that is invested primarily in employer stock.

Defined contribution retirement plans: Who has them and ...

www.bls.govemployee earnings. The contributions are allocated to individual employee accounts each year. Some plans may allow employee contributions, but employees are not required to make contributions in order to participate. An employee stock ownership plan (ESOP) is a type of plan under which the employer pays a designated amount

Chapter 8 Examining Employee Stock Ownership Plans …

www.irs.govand non-leveraged employee stock ownership plans. This chapter describes the qualification requirements under IRC sections 401(a) and 409, as well as the additional requirements for ESOPs under IRC section 4975(e)(7) and the applicable regulations, related to both leveraged and non-leveraged ESOPS.

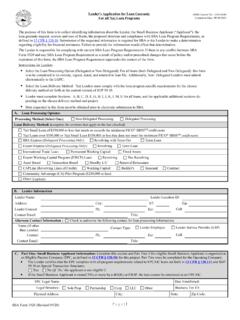

SBA Form 1920 - Small Business Administration

www.sba.govF. Employee Stock Ownership Plan (“ESOP”) -N/A Complete if the Small Business Applicant is a Qualified Employee Trust or equivalent ... All questions below must be answered “Yes” to be eligible.) • The Qualified Employee Trust (or equivalent trust) meets the requirements and conditions for an ESOP prescribed ... Plans are excluded ...

This publication has been developed by the U.S. Department ...

www.dol.govThe information contained in the following pages answers the most common questions . about retirement plans. Keep in mind, however, that this booklet is a simplifed summary ... employee stock ownership plan (ESOP), and . proft sharing plan. ... others from a retirement plan. For example, your employer may sponsor one plan for salaried employees ...

IRB 1999-6 2/3/99 1:39 PM Page 1 Internal ... - IRS tax forms

www.irs.govFollowing Ownership Change The adjusted federal long-term rate is set forth for the month of February 1999. See Rev. Rul. 99–8, page 10. Section 411.—Minimum Vesting Standards 26 CFR 1.411(d)–4: Section 411(d)(6) protected benefits. T.D. 8806 DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 Employee Stock Ownership Plans ...

Strategic Management

irresearchers.irand Analysis 7 & Adapting to Change 8 Key Terms in Strategic Management 9 ... Examining Strategy Articles 168 Assurance of Learning Exercise 5C: Classifying Some Year 2009 Strategies 169 ... Employee Stock Ownership Plans (ESOPs) 239 & Balancing Work

Wells Fargo & Company 401(k) Plan

teamworks.wellsfargo.comEmployee stock ownership plan 1. Before reading this SPD 1. Your consent 2. Get started 2. 401\(k\) Plan eligibility requirements 2. Employment classification 2. Eligible employees 3. Ineligible employees 3. Employees of an acquired company 4. Rehired employees 4. Inter-affiliate transferred employees 4. Section 16\⠀戀尩 officers 5

Employee Stock Ownership Plans (ESOP) - Wickens Law

www.wickenslaw.comBOT-00046.089\603133.doc Richard A. Naegele Attorney at Law Fellow, American College of Employee Benefits Counsel 35765 Chester Road Avon, OH 44011-1262 Main: (440) 930-8000 Direct: (440) 930-8074 Fax: (440) 930-8098

PA Department of Revenue 2019

www.revenue.pa.govDistribution from Charitable Gift Annuities M. Distribution from Employee Stock Ownership Plan Describe: Name shown first on the PA-40 (if filing jointly) Social Security Number (shown first) Summary of PA-Taxable Employee, Non-employee and Miscellaneous Compensation. PA-40 W-2S . 09-19 (FI) PA Department of Revenue 1901910057 1901910057

Parsons ESOP Highlights - retirementfocus.com

www.retirementfocus.comThe Parsons Employee Stock Ownership Plan (the ESOP) is an important retirement benefit at Parsons. The ESOP offers ... The ESOP is entirely funded by Parsons and its affiliates in the form of common stock. ... You may designate a beneficiary or revoke such a designation at any time. If you are married at the time of

Accounting for ESOP transactions - RSM US

rsmus.comleveraged employee stock ownership plan (ESOP) transaction has been implemented and the financing obtained. To start educating the plan sponsor on the accounting treatment of leveraged ESOPs at that late date is likely to be an unhappy experience. By that time, the transaction may be too far down

Instructions for Form 5330 (Rev. December 2021)

www.irs.govfunded welfare benefit plan that provides a disqualified benefit during any tax year. 11. An employer who pays excess fringe benefits and has elected to be taxed under section 4977 on such payments. 12. An employer or worker-owned cooperative, as defined in section 1042(c)(2), that maintains an employee stock ownership plan (ESOP) that

2021 Instructions for Forms 1099-R and 5498

www.freetaxusa.comdividends from an employee stock ownership plan (ESOP), including a tax credit ESOP, are reported on Form 1099-R. Distributions other than section 404(k) dividends from the plan must be reported on a separate Form 1099-R. Section 404(k) dividends paid directly from the corporation to participants or their beneficiaries are reported on Form 1099 ...

Summary Plan Description General Mills 401(k) Plan

cache.hacontent.comThe General Mills 401(k) Plan is a qualified retirement plan and employee stock ownership plan (ESOP). The Plan allows you to save for retirement on a tax-favored basis through a combination of contributions you make by payroll deduction and matching contributions made on your behalf by General Mills.

ESOP - NTMA

www.ntma.orgSince their origin in 1956, the number of employee stock ownership plan (ESOP) companies has grown to almost 11,000. ESOPs are used for many reasons, including providing

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS GENERAL ...

nb.fidelity.com• Payments of employee stock ownership plan (ESOP) dividends; • Corrective distributions of contributions that exceed tax law limitations; • Loans treated as deemed distributions (for example, loans in default due to missed payments before your employment ends); • Cost of life insurance paid by the Plan;

Similar queries

Plan, Stock, Employee stock ownership, Employee stock ownership plan, Defined contribution retirement plans: Who has, Employee, Plans, ESOP, Employee Stock Ownership Plans, Small Business Administration, Questions, Sponsor, IRS tax forms, Ownership, Strategic Management, Examining, Wells Fargo & Company 401(k) Plan, Company, Employee Stock Ownership Plans ESOP, Form, Beneficiary, Designation, Financing, Instructions for Form 5330, Summary Plan Description General Mills 401