Search results with tag "Of income"

GOVERNMENT OF INDIA MINISTRY OF ... - Income Tax …

www.incometaxindia.gov.inSUBJECT: INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2019-20 UNDER SECTION 192 OF THE INCOME-TAX ACT, 1961. ***** Reference is invited to Circular No. 1/2019 dated 01.01.2019 whereby the rates of deduction of income-tax from the payment of income under the head "Salaries" under

Chapter 7 Earnings & Profits and Distributions

www.ftb.ca.govtax purposes because of different treatments with respect to reserves, depreciation, and depletion. E&P for tax purposes also rarely equals taxable income because of non-cash deductions (e.g., dividend received deductions) and exclusion of specific items of income (e.g., federal income tax refund) that are allowed in computing taxable income.

Government of India Ministry of Finance Central …

www.incometaxindiaefiling.gov.inPage 1 of 5 DGIT(S)/ADG(S)-2/Notification/106/2018 Government of India Ministry of Finance Central Board of Direct Taxes Directorate of Income Tax (Systems)

Medical Assistance Treatment of Assests and Income

www.house.leg.state.mn.usGeneral Income and Asset Limits in the MA Program . The MA program sets limits on the amount of income and the value of assets a recipient may have. Income. is defined as net countable income after certain allowable deductions have been subtracted. Assets. include all real and personal property owned by the recipient. When a

Part I - IRS tax forms

www.irs.gov1. Wages fall within the definition of income set forth in section 61(a)(1) of the Internal Revenue Code. Taxpayer A’s wages and other compensation for services are income subject to federal income tax and must be reported on Taxpayer A’s federal income tax return. 2. The payment of wages and other compensation for personal services is

CHARITIES SORP (FRS 102) - GOV.UK

assets.publishing.service.gov.ukrecognition of income, including legacies, grants and contract income..... 50 introduction..... 50 understanding the nature of income ..... 50 general rules for income recognition ...

ALLOCATION OF INCOME AND LOSS - taxtaxtax.com

taxtaxtax.comALLOCATION OF INCOME AND LOSS 900 INTRODUCTION 900.1 A partnership is not subject to tax at the partnership level. The partnership’s items of income, gain,

Getting Started withTDS in Tally.ERP 9

mirror.tallysolutions.com1 Introduction TDS means Tax Deducted at Source. The concept of TDS was introduced in the Income Tax Act, 1961, with the objective of deducting the tax on an income, at the source of income.

2018 Verification Document: Student Statement of …

www.unf.eduRevised 9/22/16 (904) 620-5555 (p) (904) 620-2414 (f) 2017-2018 Verification Form: Student Statement of Income Section III: Description of Circumstances Please describe the circumstances regarding your (and your spouse’s, if applicable) source(s) of income for 2015 in the space provided

Maumee Tax Return 2018 - Welcome to City of …

www.maumee.orgOFFICE (419) 897-7120 MON. THRU FRI.: 8:00 TO 4:30 www.maumee.org email: tax@maumee.org 2017 MAUMEE INCOME TAX RETURN DIVISION OF INCOME TAX 400 CONANT STREET • MAUMEE, OHIO 43537-3300 DUE APRIL 15, 2018 OR THE IRS DUE DATE for Calendar Year 2017

FORM NO. 15H claiming certain incomes without deduction of ...

www.lichousing.com6In case any declaration(s) in Form No. 15H is filed before filing this declaration during the previous year, mention the total number of such Form No. 15H filed along with the aggregate amount of income for which said declaration(s) have been filed.

IT-GEN-04-G01 - How to complete the Income Tax Return ...

www.sars.gov.zaCOMPLETE THE INCOME TAX RETURN ( ITR14) FOR COMPANIES IT-GEN-04-G01 REVISION: 12 Page 11 of 166 • Note: For the administrative penalties for non compliance in terms of income tax return - submission refer to GG 41996 …

PART-TIME FEE GRANT (PTFG) NOTES 2018-2019 - saas.gov.uk

www.saas.gov.uk6 Evidence of income from employment If you are in employment, please give us one of the following documents: if you are paid monthly, 4 weekly or fortnightly, your three most recent payslips if you are paid weekly, three payslips you have received in the last three months a letter from your employer confirming your monthly or weekly gross salary for each of the last 3

Major sources of income subject to deduction or …

nbr.gov.bdSerial No Heads Withholding authority Rate To be paid in favour of 6 পরিরিষ্ট(1) Advisory or consultancy service (2) Professional service,

WEST VIRGINIA EMPLOYER’S WITHHOLDING TAX …

www.state.wv.us3 WV/IT-104 WEST VIRGINIA CERTIFICATE OF NONRESIDENCE Rev. 1/07 To be completed by employees who reside in Kentucky, Maryland, Ohio, Pennsylvania or Virginia. If you are a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia and your only source of income from West Virginia i s wages or

Establishing and Using a Farm Financial Record-Keeping System

www.agecon.okstate.edu1 Why keep records? Records are important for many reasons: Proof: The IRS can ask forproof of income, expense and inventory items re-ported on tax returns.

2017 KPI, Partner's Share of Income, Credits and Modifications

www.revenue.state.mn.us2017 KPI, Partner’s Share of Income, Credits . and Modifications. Partnership: Complete and provide Schedule KPI to each nonresident individual, estate or trust partner and any Minnesota individual, estate or trust partner who has

LB&I Concept Unit Knowledge Base - International

www.irs.govDRAFT ! Relevant Key Factors (cont’d) Sourcing of Income . Key Factors CAUTION: With respect to the definition of United States, see IRC 638 and 7701(a)(9): Generally, the U.S. includes the 50

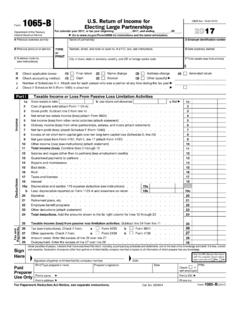

2017 Form 1065-B - Internal Revenue Service

www.irs.govForm 1065-B Department of the Treasury Internal Revenue Service U.S. Return of Income for Electing Large Partnerships For calendar year 2017, or tax year beginning, 2017, and ending, 20.

BANK BRANCH STATUTORY AUDIT – CERTAIN ASPECTS …

paryca.orgtreatment given as to revenue/ capital/ deferred expenses. o Check accrual of income/ expenditure especially for the last month of the financial year.

Evaluation of real estate property and market risk - …

www.unece.org© Copyright 2012, UNECE REM | 8 (a) The effective verification of income and financial information (b) Reasonable debt service coverage (c) Realistic qualifying ...

Itemized Deduction Worksheet TAX YEAR - MaceykoTax

maceykotax.comItemized Deduction Worksheet Medical Expenses. Must exceed 7.5% of income to be a benefit. Include cost for dependents-do not include any expenses that were reimbursed by insurance

Income-tax deduction from salaries during the financial ...

www.incometaxindia.gov.in2.3.1 Education Cess on Income tax: The amount of income-tax including the surcharge if any, shall be increased by Education Cess on Income Tax at the rate of two percent of the income-tax.

Income & Franchise Tax Audit Manual - mtc.gov

www.mtc.gov2.04 Apportionment Formula.The manner of computing the portion of a taxpayer’s income subject to tax in a particular state. The standard Uniform Distribution of Income for Tax Purposes Act (UDITPA) formula is ors the average of three fact

Similar queries

OF ... - Income Tax, Income, Of income-tax, Of Income, 7 Earnings & Profits and Distributions, Income Tax, Government of India Ministry, Property, IRS tax forms, FRS 102, Recognition of income, including legacies, Income recognition, ALLOCATION OF INCOME AND LOSS, Getting Started, 2018 Verification Document: Student Statement of, Student Statement of Income, OHIO, Form, COMPLETE THE INCOME TAX RETURN, Return, Submission, GRANT, PTFG, Employer, Deduction, West Virginia, WITHHOLDING TAX, Maryland, 2017, Of Income, Credits and Modifications, Of Income, Credits . and Modifications, Concept, Definition, Form 1065-B, Internal Revenue Service, BANK BRANCH STATUTORY AUDIT – CERTAIN ASPECTS, Real estate property and market risk, Itemized Deduction Worksheet TAX YEAR, Tax deduction, Income & Franchise Tax Audit Manual, Apportionment