Search results with tag "Louisiana revenue"

PARTNERSHIP RETURN OF INCOME - Louisiana Revenue

www.revenue.louisiana.govaccounting period established on the first return must remain as the accounting period for subsequent years under Louisiana Income Tax Law, unless permission to make a change is received from the Secretary of Revenue. A change by any partnership from one taxable year to another, or the adoption by a new partnership for an initial taxable year, must

GENERAL INSTRUCTIONS - Louisiana Revenue

www.revenue.louisiana.govForm CIFT-620A, which provides schedules for the allocation of the franchise taxable base. ALL TAXPAYERS ARE REQUIRED TO ANSWER LINES A-I. LINE 1A – LOUISIANA NET INCOME Information regarding the computation of Louisiana net income is provided in the instructions for Schedule D of Form CIFT-620 and Schedule P of Form CIFT-620A.

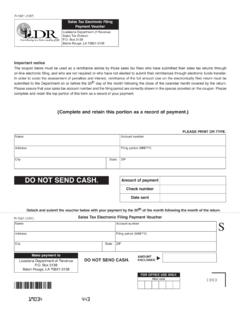

DO NOT SEND CASH. - Louisiana Revenue

www.revenue.louisiana.govImportant notice The coupon below must be used as a remittance advice by those sales tax filers who have submitted their sales tax returns through

Credit for Taxes Paid to Other States ... - Louisiana Revenue

revenue.louisiana.govR-540-G1 (7/15) Credit for Taxes Paid to Other States Worksheet for IT-540 and IT-541 2014 and Prior Tax Years This worksheet has been created to reflect the restrictions for the credit for taxes paid to other states according to Act 109 of the 2015