Search results with tag "Return preparer fraud or misconduct affidavit"

Disaster Resource Guide

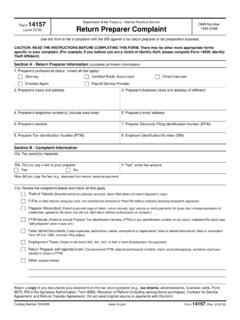

www.irs.govclients; however, some preparers are dishonest. Report abusive tax preparers and suspected tax fraud to the IRS. Use Form 14157, Complaint: Tax Return Preparer. If you suspect a return preparer filed or changed the return without your consent, you should also file Form 14157-A, Return Preparer Fraud or Misconduct Affidavit. You can get these forms

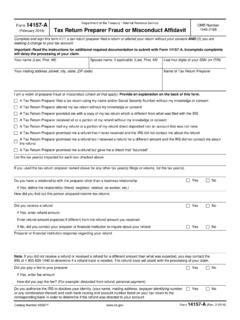

Form 14157-A Tax Return Preparer Fraud or Misconduct …

www.irs.govSpecific Instructions: Consideration of your complaint will be delayed if the required documentation below is not included. In order for your complaint to be considered, you must submit: Forms: Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit - Complete form in its entirety and sign under penalties of perjury.

14157 (June 2018) Return Preparer Complaint

www.irs.govIf a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account, complete Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit, in addition to Form 14157. Submit both forms along with