Search results with tag "To be sent to the zao"

CHALLAN Tax Applicable NO./ (0020) INCOME-TAX ON …

www.tin-nsdl.comPrinted from www.taxmann.com * Important : Please see notes overleaf before filling up the challan Single Copy (to be sent to the ZAO) CHALLAN Tax Applicable (Tick One)* NO./ (0020) INCOME-TAX ON COMPANIES Assessment Year ITNS 280 (CORPORATION TAX) - (0021) INCOME TAX (OTHER THAN

T.D.S./TCS TAX CHALLAN Copy

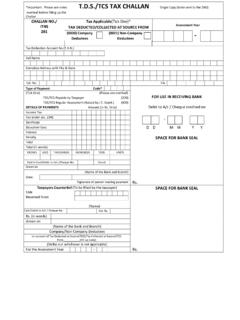

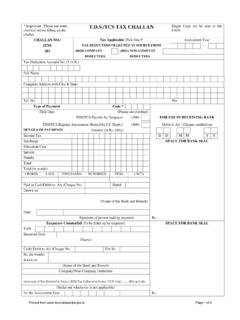

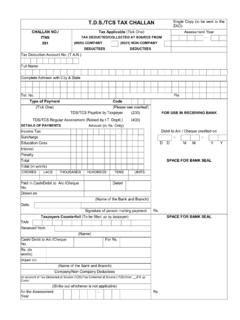

www.tin-nsdl.com*Important : Please see notes T.D.S./TCS TAX CHALLAN Single Copy (to be sent to the ZAO) overleaf before filling up the Challan Tax Applicable(Tick One)* TAX DEDUCTED/COLLECTED AT SOURCE FROM Assessment Year

T.D.S./TCS TAX CHALLAN - Income Tax Department

www.incometaxindia.gov.in* Important : Please see notes overleaf before filling up the challan T.D.S./TCS TAX CHALLAN Single Copy (to be sent to the ZAO) CHALLAN NO./ Tax Applicable (Tick One)* Assessment Year

CHALLAN Tax Applicable NO./ (0020) INCOME-TAX ON …

www.incometaxindia.gov.inSingle Copy (to be sent to the ZAO) CHALLAN Tax Applicable (Tick One)* NO./ (0020) INCOME-TAX ON COMPANIES Assessment Year ITNS 280 (CORPORATION TAX) - (0021) INCOME TAX (OTHER THAN COMPANIES) Permanent Account Number Full Name Complete Address with City & State Tel. No. Pin ...

CHALLAN NO. Assessment Year ITNS 281 (0021) NON – …

www.drsmcpl.inT.D.S./TCS TAX CHALLAN Single copy (to be sent to the ZAO) Tax Applicable (Tick One) CHALLAN NO. TAX DEDUCTED / COLLECTED AT SOURCE FROM Assessment Year ITNS 281 (0020) COMPANY DEDUCTEES (0021) NON – COMPANY DEDUCTEES - Tax Deduction Account Number (TAN) Full Name Complete Address with city & state Tel. No PIN Type of …

DEDUCTEES DEDUCTEES Tax Deduction Account No. (T.A.N.) …

www.aadisol.inT.D.S./TCS TAX CHALLAN Single Copy (to be sent to the ZAO) CHALLAN NO./ Tax Applicable (Tick One) Assessment Year ITNS TAX DEDUCTED/COLLECTED AT SOURCE FROM- 281 (0020) COMPANY (0021) NON-COMPANY DEDUCTEES DEDUCTEES Tax Deduction Account No. (T…

T.D.S./TCS TAX CHALLAN

www.incometaxindia.gov.inchallan T.D.S./TCS TAX CHALLAN Single Copy (to be sent to the ZAO) CHALLAN NO./ Tax Applicable (Tick One)* Assessment Year ITNS TAX DEDUCTED/COLLECTED AT SOURCE FROM - 281 (0020) COMPANY (0021) NON-COMPANY DEDUCTEES DEDUCTEES Tax Deduction Account No. (T.A.N.) Full Name Complete Address with City & State