Search results with tag "Kansas department of revenue"

Power of Attorney TR-41 - Kansas Department of Revenue

www.ksrevenue.orgKANSAS DEPARTMENT OF REVENUE POWER OF ATTORNEY www.ksrevenue.org (For vehicles only) I the undersigned vehicle owner, hereby appoint: (Name) My true and lawful attorney-in-fact, to apply for a Certificate of Title and/or Registrations upon and/or endorse and transfer title thereto for the following described vehicle: Year:

DO-10 Power of Attorney Rev. 8-20 - Kansas Department of ...

www.ksrevenue.orgmustcomplete,sign,and return thisformifyou wish to granta powerofattorney(POA)to an attorney,accountant, agent, tax return preparer, family member, or anyone else to act on your behalf with the Kansas Department of Revenue (KDOR).You mayuse this form for any matter affecting anytaxadministered by the department, including

Application for S T E C - Kansas Department of Revenue

www.ksrevenue.orgSome exemption certificates also require a buyer to furnish the Kansas tax account number or a description of the buyer’s business. The exemption certificates for nonprofit organizations require the federal employers ID number (EIN) of the organization. ASSIGNED EXEMPTION NUMBER(S) There are four types of exemption certificates that

Real ID Notice - Kansas Department of Revenue

www.ksrevenue.orgNOTICE!! Effective August 1, 2017, the State of Kansas will be completing the final piece of REAL ID compliance. State of Kansas residents will have the option

STATE AND LOCAL SALES/USE TAX RATE CHANGES

ksrevenue.govwebsite 60 days in advance (see EDU-96). For a current listingof the sales tax rates, visit the Kansas Department of Revenue website at: ksrevenue. gov /salesratechanges.html. EDU-96 Rev. 7-21. DIVISION OF TAXATION. 120 SE 10. th. Ave. PO BOX 3506. TOPEKA, KS 66601 -3506 PHONE: 785-368-8222 FAX: 785-296-2073 www.ksrevenue.gov

2022 Personal Property Guide - Kansas Department of …

ksrevenue.govThe Personal Property Valuation Guide is written by the Property Valuation Division in the Kansas Department of Revenue. It is intended to be used by county appraisers as the actual personal property valuation guide for the purposes of P.V.D. Directive 17-048, K.S.A. 79-505, 79-1412a Sixth and K.S.A. 79-1456.

Individual Income Tax - Kansas Department of Revenue

www.ksrevenue.org2017 Individual Income Tax For a fast refund, file electronically! See back cover for details. ksrevenue.org. Page 2. ... The new tax rate for a married individual filing a joint return with taxable income of $30,000 or less is 2.9%; taxable income of $30,001 to $60,000 is

2017 DEALER LICENSING and SALESPERSON HANDBOOK

ksrevenue.govKansas requires a license issued by Kansas Department of Revenue, Dealer Licensing. A vehicle dealer constitutes a person who purchases a vehicle with the intent to sell for a profit, or sells 5 or more vehicles within a calendar year. In this Dealer Handbook you will find complete instructions and licensing requirements for Kansas Vehicle and ...

2018 Personal Property Guide - Kansas …

www.ksrevenue.orgState of Kansas Department of Revenue Sam Brownback, Governor Samuel M. Williams, Secretary Division of Property Valuation David N. Harper, Director

Alabama - National Conference of State Legislatures

www.ncsl.orgKansas $30 for vehicles less than 4,500 lbs.; or $40 for vehicles over 4,500 lbs. Time Frame: Annual Additional Notes: Additional property taxes levied by the counties. Senior Discount: No Electric Vehicle Fee: No Source: Kan. Stat. Ann. §8-143 and §8-145d, Kansas County Treasure’s Association, and Kansas Department of Revenue

D-19 Guarantee of Compliance

www.ksrevenue.orgKansas Department of Revenue Division of Vehicle Dealer Licensing Bureau Docking State Office Building Topeka, KS 66626-0001 Ph (785) 296-3621 Fax (785)296-5854

Information Guide - Kansas Department of Revenue

ksrevenue.orgAll Janitorial Service providers must pay tax on purchases of tangible personal property or equipment and collect tax on sales of services as shown.

2017 DEALER LICENSING and SALESPERSON HANDBOOK

www.ksrevenue.orgINTRODUCTION. Doing business as a vehicle, manufactured home dealer or salesperson in the state of Kansas requires a license issued by Kansas Department of Revenue, Dealer Licensing.

Corporate Income Tax - Kansas Department of Revenue

www.ksrevenue.orgA Kansas Corporate income tax return must be filed by all corporations doing business in or deriving income from sources within Kansas who are required to file a federal income tax return, whether or not a tax …

Scroll down for return - Kansas Department of Revenue

www.ksrevenue.orgINSTRUCTIONS FOR FORM KW-5, KANSAS WITHHOLDING TAX DEPOSIT REPORT Use this form to report the Kansas income tax withheld from wages and/or other taxable payments as required by law.

Medical Certification Form - Kansas Department of Revenue

ksrevenue.orgEmail: kdor_medical.certification@ks.gov Fax: 785-296-5859 Part B I certify my commercial transportation is: (Check only one of the following categories that apply to you). ☐ Category 1. Interstate, and I am both subject to and meet 49 CFR Part 391. (Copy of DOT medical card and this certification must be submitted to th e State Driver’s ...

MF-51 Application for MF Special Fuel Tax Refund Permit ...

www.ksrevenue.orgKANSAS DEPARTMENT OF REVENUE. APPLICATION FOR MOTOR VEHICLE/SPECIAL FUEL TAX REFUND PERMIT. 1. Legal Name of Company or Applicant: 2. DBA Name (if applicable):

DO-5 Name or Address Change Form Rev. 8-17

www.ksrevenue.orgKANSAS DEPARTMENT OF REVENUE Division of Taxation. NAME OR ADDRESS CHANGE FORM. Individual. Current Name: o I am changing my name. (Name return was filed under)

30-Day Print-on-Demand Temporary Permits …

www.ksrevenue.org30-Day Print-on-Demand Temporary Permits ... If I am already registered with the Kansas Department of Revenue for sales ... The system is available 24 hours ...

Kansas Vehicle Bill of Sale Form TR-312

eforms.comKANSAS DEPARTMENT OF REVENUE BILL OF SALE www.ksrevenue.org This Bill of Sale is an affidavit of the amount of money or value that was exchanged between the seller(s) and buyer(s) for the vehicle listed herein. ONLY antique vehicles (vehicles 35 years old or older) can have the ownership transferred (sold) by bill of sales.

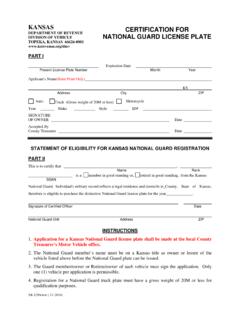

KANSAS CERTIFICATION FOR DEPARTMENT OF REVENUE …

www.ksrevenue.orgkansas department of revenue division of vehicle topeka, kansas 66626-0001 www.ksrevenue.org/dmv. certification for national guard license plate

KANSAS DEPARTMENT OF REVENUE ABANDONED …

www.ksrevenue.orgStaple Attachments Here KANSAS DEPARTMENT OF REVENUE DIVISION OF VEHICLES www.ksrevenue.org ABANDONED VEHICLE AFFIDAVIT (Public Agency Use Only) Please Type or …

Kansas Driving Handbook - Kansas Department of …

www.ksrevenue.orgThe Kansas Department of Revenue strives to make your experience with the Division of Vehicles quicker, more user-friendly, and convenient. Our …

KANSAS DEPARTMENT OF REVENUE RESALE EXEMPTION …

www.nuvidia.comKANSAS DEPARTMENT OF REVENUE DESIGNATED OR GENERIC EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or …

KANSAS REQUEST FOR - Kansas Department of Revenue

www.ksrevenue.orgAs reviewed in No. 1 and 2 below, the lien holder will have a set number of days (based on payment method) to fully execute the release of lien and mail or deliver the release where directed by the person or business shown above.

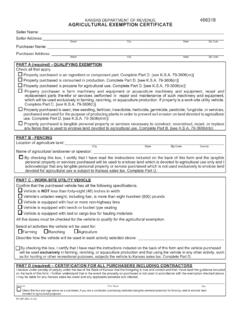

KANSAS DEPARTMENT OF REVENUE 466318

ksrevenue.govused on growing agricultural crops for resale or used in the processing or storage of fruit, vegetables, feeds, seeds, and grains; antibiotics, ... Kansas Sales & Use Tax for the Agricultural Industry, at . ksrevenue.g. ov for additional information. ST-28F (Rev. 12-21) 466318.

Kansas Department of Revenue Manual Title Application …

ksrevenue.orgpersons must sign this application. Vehicles with a GVWR of 26,000 lbs or less cannot use this form to add a second lien. Please use the Refinance Secured Title Application, form TR-720R. If a replacement title is being requested, attach the current title to this application if the reason selected is mutilated or has become illegible.

KANSAS DEPARTMENT OF REVENUE 465618 DESIGNATED …

ksrevenue.govTitle: ST-28 Designated or Generic Exemption Certificate Rev. 12-21_web_fillable Author: rvesfzs Subject: This publication has been developed to address the Kansas retailers sales, compensating use, liquor drink, cigarette and tobacco, dry cleaning and transient guest tax situations that you will encounter as a hotel, motel, bed and breakfast or restaurant o perator.

Similar queries

Power of Attorney, KANSAS DEPARTMENT OF REVENUE, KANSAS DEPARTMENT OF REVENUE POWER OF ATTORNEY www.ksrevenue.org, Attorney, Kansas Department, Powerofattorney, Department, Certificates, Kansas, Real ID Notice, NOTICE, REAL ID, DIVISION OF TAXATION, Kansas Department of, Division, Individual Income Tax, 2017 Individual Income Tax, Individual, Income, Dealer, Vehicle dealer, Vehicle, Kansas Vehicle, Personal Property Guide, National Conference of State Legislatures, Guarantee of Compliance, Information Guide, DEALER LICENSING and SALESPERSON, Corporate Income Tax, Corporate income tax return, Income tax return, Scroll down for return, Certification Form, Certification, APPLICATION FOR MOTOR VEHICLE/SPECIAL, 5 Name or Address Change Form, NAME OR ADDRESS CHANGE FORM, Name, Print-on-Demand Temporary Permits, Sales, Hours, Kansas Vehicle Bill of Sale Form, DEPARTMENT OF REVENUE, KANSAS DEPARTMENT OF REVENUE ABANDONED, KANSAS DEPARTMENT OF REVENUE RESALE EXEMPTION, EXEMPTION, REQUEST FOR, Storage, Application, Generic